The U.S. equities finished lower on Friday with markets continuing to focus on the Federal Reserve, which will hold its two-day FOMC meeting starting next Tuesday.

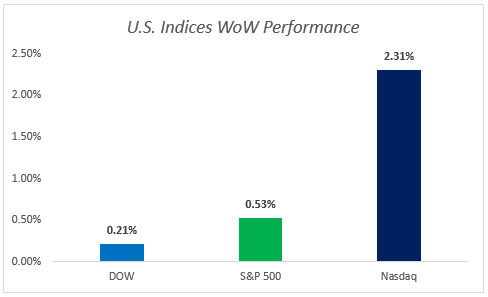

The Dow Jones industrial average was down 88.68 points (-0.49%), driven mostly by Goldman Saches and United Technologies, to close at 18,085.45. The S&P 500 dropped 8.1 points (-0.38%) to 2,139.16, with financials and energy lagging. The tech-heavy Nasdaq composite closed mostly flat at 5,125.91.

On Monday, three Federal Reserves officials, including Board Governor and voting member Lael Brainard, took a dovish stance on the direction of interest rates. As a result, the markets responded positively anticipating lower odds of a September rate hike.

On Wednesday, world crude oil prices fell about 3 percent after the EIA report, which indicated that the U.S. inventories of distillates rose by 4.6 million barrels in the week to Sept. 9, much higher than the consensus of 1.5 million barrels. Brent crude futures settled down $1.25 (-2.7%), at $45.85 per barrel. U.S. West Texas Intermediate (WTI) crude futures dropped $1.32 (-2.9%) to settle at $43.58. The market continues to focus on the next production freeze talk between OPEC and other oil producers, which is expected to be held on September 26 to 28.

On Thursday, U.S. retail sales fell 0.3% in August, worse than the street expectation of a 0.1% drop. In addition, August industrial production also dropped 0.4% against 0.3% decline expected. Both events were widely viewed as allowing the Fed to keep rate hike off the table next week. However, the weekly jobless claims of 260,000 was higher than analyst consensus of 265,000.

On Friday, U.S. CPI result for August was better than expected as rising rents and health care costs more than offset a decline in gasoline prices, indicating a gradual increase in inflation which could position the Federal Reserve to raise interest rates this year.

Thoughts: Although the market has priced in the lower odds of a September rate hike after the sluggish economic data throughout the week, two interest rate hikes remain on the table assuming the Fed would want to uphold its credibility as explained by my previous post. Investors seem to be convinced in this way because 1)economic growth remains steady at best as pointed out by recent economic indicators: mild inflation and employment is still slightly below full employment; and 2)it is election year, political consequences have hindered the Fed to tighten its monetary policy historically (this conventional view is broadly acceptable, but here is the caveat).

The week ahead (watch out for volatility): September FOMC 2-day meeting (Tuesday), Bank of Japan will announce policy decision, a few hours before the conclusion of the FOMC meeting (Wednesday), and ECB president Mario Draghi will speak in Frankfurt (Thursday).

About AM_Journey

A small potato working on Bay Street

Tops News

Tops News Economic Calendar & News

Economic Calendar & News Economy

Economy

Market Commentary – September 16, 2016

The U.S. equities finished lower on Friday with markets continuing to focus on the Federal Reserve, which will hold its two-day FOMC meeting starting next Tuesday.

The Dow Jones industrial average was down 88.68 points (-0.49%), driven mostly by Goldman Saches and United Technologies, to close at 18,085.45. The S&P 500 dropped 8.1 points (-0.38%) to 2,139.16, with financials and energy lagging. The tech-heavy Nasdaq composite closed mostly flat at 5,125.91.

On Monday, three Federal Reserves officials, including Board Governor and voting member Lael Brainard, took a dovish stance on the direction of interest rates. As a result, the markets responded positively anticipating lower odds of a September rate hike.

On Wednesday, world crude oil prices fell about 3 percent after the EIA report, which indicated that the U.S. inventories of distillates rose by 4.6 million barrels in the week to Sept. 9, much higher than the consensus of 1.5 million barrels. Brent crude futures settled down $1.25 (-2.7%), at $45.85 per barrel. U.S. West Texas Intermediate (WTI) crude futures dropped $1.32 (-2.9%) to settle at $43.58. The market continues to focus on the next production freeze talk between OPEC and other oil producers, which is expected to be held on September 26 to 28.

On Thursday, U.S. retail sales fell 0.3% in August, worse than the street expectation of a 0.1% drop. In addition, August industrial production also dropped 0.4% against 0.3% decline expected. Both events were widely viewed as allowing the Fed to keep rate hike off the table next week. However, the weekly jobless claims of 260,000 was higher than analyst consensus of 265,000.

On Friday, U.S. CPI result for August was better than expected as rising rents and health care costs more than offset a decline in gasoline prices, indicating a gradual increase in inflation which could position the Federal Reserve to raise interest rates this year.

Thoughts: Although the market has priced in the lower odds of a September rate hike after the sluggish economic data throughout the week, two interest rate hikes remain on the table assuming the Fed would want to uphold its credibility as explained by my previous post. Investors seem to be convinced in this way because 1)economic growth remains steady at best as pointed out by recent economic indicators: mild inflation and employment is still slightly below full employment; and 2)it is election year, political consequences have hindered the Fed to tighten its monetary policy historically (this conventional view is broadly acceptable, but here is the caveat).

The week ahead (watch out for volatility): September FOMC 2-day meeting (Tuesday), Bank of Japan will announce policy decision, a few hours before the conclusion of the FOMC meeting (Wednesday), and ECB president Mario Draghi will speak in Frankfurt (Thursday).

Share this:

About AM_Journey

A small potato working on Bay Street