The U.S. equities finished higher on Friday as Deutsche Bank, the largest German lender, was close to a much-lower $5.4 billion settlement with the Department of Justice.

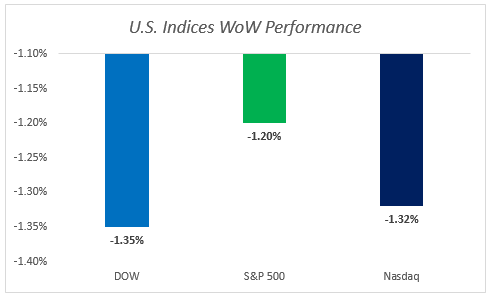

The Dow Jones industry average finished up 164.7 points (0.91%) at 18,143.45. Both the S&P 500 and the Nasdaq composite gained 0.8% to close at 2,151.13 and 5,269.15, respectively.

On Tuesday, the U.S. stock markets had a risk-on rally as investors perceived the victory of the first head-on presidential debate on Monday night went to Hillary Clinton and priced in higher odds that Clinton will become the next President.

On Wednesday, OPEC members surprised the market and announced that they have reached a preliminary agreement for a production cap to help re-balance the global crude oil market, but did not disclose further details until end of November. Market consensus indicates that a potential reduction of 500,000 to 750,000 barrels per day will be trimmed from the August level of 33.2 million barrels per day. Both Brent and WTI Crude Oil prices gained over 7% for the week. In addition, The Fed Chair Janet Yellen testified before the House Financial Services Committee, with no changes in her tone since the FOMC meeting concluded last week. The market continues to anticipate higher odds of a rate hike in December. Also on the same day, John Stumpf, CEO of Wells Fargo, faced another round of grilling from the House Committee. He agreed to forgo all unvested equity awarded to him, worth $41 million, not rewarded with a bonus for 2016; take no salary during an independent investigation by the board.

On Thursday, Q2 GDP For the U.S. economy was revised slightly upward to 1.4%. The US Federal Reserve banks of New York and Atlanta expect an average of 2.5% for the third quarter.

On Friday, after a two-day plummet of Deutsche Bank’s share price over the viability of Germany’s largest lender, the bank rallied 14% to finish the last trading day of September, after AFP reported that it might only pay $5.4 billion in a settlement with the US Department of Justice, rather than the $14 billion initially suggested.

The week ahead: (Monday) U.S. Manufacturing PMI for September; (Wednesday) US ADP Non-Farm Employment Change, U.S. ISM Non-Manufacturing PMI, and U.S. Crude Oil inventories; (Friday) US Non-Farm Payrolls for September.

About AM_Journey

A small potato working on Bay Street

Tops News

Tops News Economic Calendar & News

Economic Calendar & News Economy

Economy

Market Commentary – September 30, 2016

The U.S. equities finished higher on Friday as Deutsche Bank, the largest German lender, was close to a much-lower $5.4 billion settlement with the Department of Justice.

The Dow Jones industry average finished up 164.7 points (0.91%) at 18,143.45. Both the S&P 500 and the Nasdaq composite gained 0.8% to close at 2,151.13 and 5,269.15, respectively.

On Tuesday, the U.S. stock markets had a risk-on rally as investors perceived the victory of the first head-on presidential debate on Monday night went to Hillary Clinton and priced in higher odds that Clinton will become the next President.

On Wednesday, OPEC members surprised the market and announced that they have reached a preliminary agreement for a production cap to help re-balance the global crude oil market, but did not disclose further details until end of November. Market consensus indicates that a potential reduction of 500,000 to 750,000 barrels per day will be trimmed from the August level of 33.2 million barrels per day. Both Brent and WTI Crude Oil prices gained over 7% for the week. In addition, The Fed Chair Janet Yellen testified before the House Financial Services Committee, with no changes in her tone since the FOMC meeting concluded last week. The market continues to anticipate higher odds of a rate hike in December. Also on the same day, John Stumpf, CEO of Wells Fargo, faced another round of grilling from the House Committee. He agreed to forgo all unvested equity awarded to him, worth $41 million, not rewarded with a bonus for 2016; take no salary during an independent investigation by the board.

On Thursday, Q2 GDP For the U.S. economy was revised slightly upward to 1.4%. The US Federal Reserve banks of New York and Atlanta expect an average of 2.5% for the third quarter.

On Friday, after a two-day plummet of Deutsche Bank’s share price over the viability of Germany’s largest lender, the bank rallied 14% to finish the last trading day of September, after AFP reported that it might only pay $5.4 billion in a settlement with the US Department of Justice, rather than the $14 billion initially suggested.

The week ahead: (Monday) U.S. Manufacturing PMI for September; (Wednesday) US ADP Non-Farm Employment Change, U.S. ISM Non-Manufacturing PMI, and U.S. Crude Oil inventories; (Friday) US Non-Farm Payrolls for September.

Share this:

About AM_Journey

A small potato working on Bay Street