The U.S. stock market traded mostly higher throughout the trading session but finished in the red after the Republicans decided to abruptly pull their health care bill on Friday as they failed to acquire enough votes to assure passage.

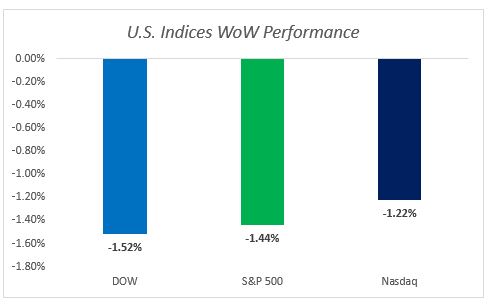

The Dow Jones industrial average dropped 59.86 points (-0.29%) to close at 20,596.72 as gains from Nike were offset by losses from Goldman Sachs and DuPont. The S&P 500 fell 1.98 points (-0.08%) to settle at 2,343.98, with Materials stocks lagging. The tech-heavy Nasdaq composite outperformed again and advanced 11.04 points (0.19%) to finish at 5,828.74. The stock market posted the worst week since election.

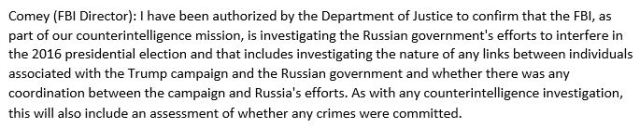

On Monday, FBI Director James Comey told Congress that FBI is investigating Trump’s link to Russia during the election period, and both Comey and NSA Director Mike Rogers stood by the conclusion that Russia attempted to influence the 2016 election in President Donald Trump’s favor. Here are a couple of excerpts of the testimony (full transcript).

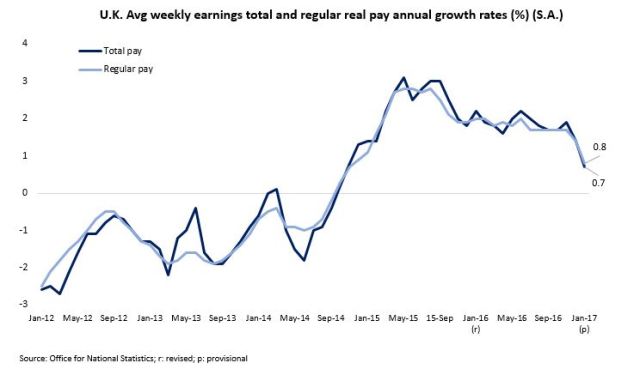

On Tuesday, U.K. released its Consumer Prices Index (CPI) result for February, and it jumped to 2.3% (vs. 2.1% economist consensus surveyed by Reuters), up from 1.8% in January, the highest since Sep 2013. This is driven by rising food and fuel prices. Although the total pay growth (including bonus) rose 2.2% between the 3 months to January 2016 and the 3 months to January 2017, real pay growth (adjusted for inflation) increased by just 0.7%, the lowest since October 2014.

Will U.K. raise its interest rate earlier than it should, given the fact that the country’s inflation has surpassed the 2% target set out by the Bank of England? Note that as discussed last week, one of the nine voting members already voted for a rate hike during its latest rate setting meeting.

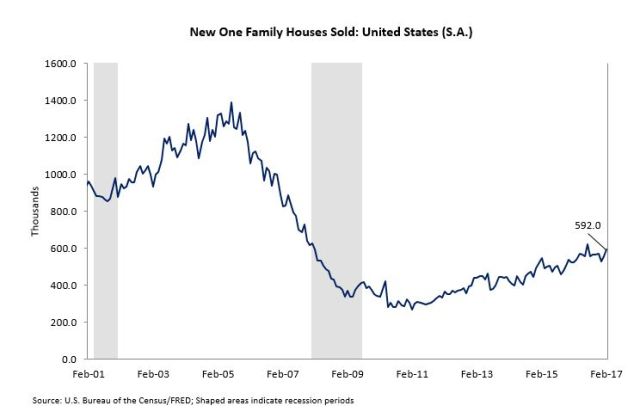

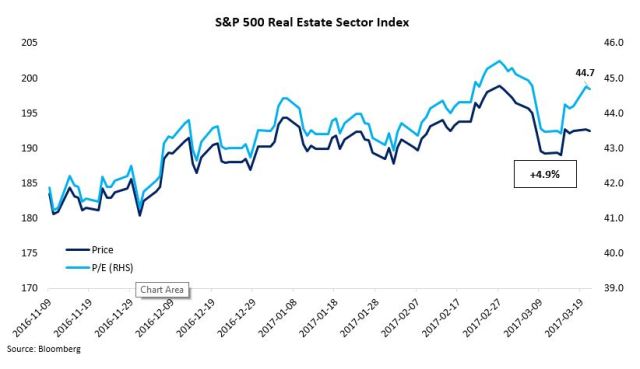

On Wednesday, the National Association of Realtors released the U.S. existing house sales figure, which dropped 3.7% for February to an annualized pace of 5.48 million units. This is driven by tight inventory and rising housing prices. Note that January’s sales pace was at 5.69 million units, the highest level since February 2007. On the other hand, U.S. new home sales reading came in strong and it is sitting at 592,000 units. It was the second highest since early 2008.

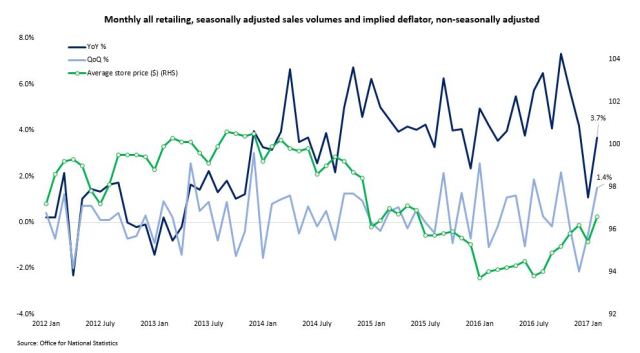

On Thursday, U.K. reported its February retail sales result, which grew 1.4% QoQ (vs. January 2017) and 3.7% YoY (vs. Feb 2016). However, the sustainability of this trend remains questionable considering higher import costs (due to weaker sterling), which will in turn leave households further squeezed by higher food and fuel prices, as mentioned above.

On Friday, U.S. President Donald Trump suffered a political setback and withdrew his healthcare bill after it failed to gain enough support to pass in Congress to repeal Obamacare, a major campaign promise of his and his allies. This reinforces the concern from the market participants that Republicans, which controls the House and the Senate, could not work together on one of its major priorities. Trump pointed out that he will go after tax reforms next during his remarks; however, the market remained hesitant to embrace his words and tumbled into the red to close for the week, as investors are concerned that the tax cut will be less than promised and the tax reform implementation will take much longer than expected.

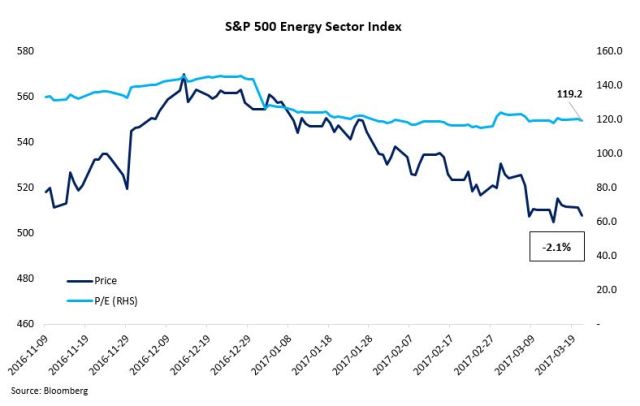

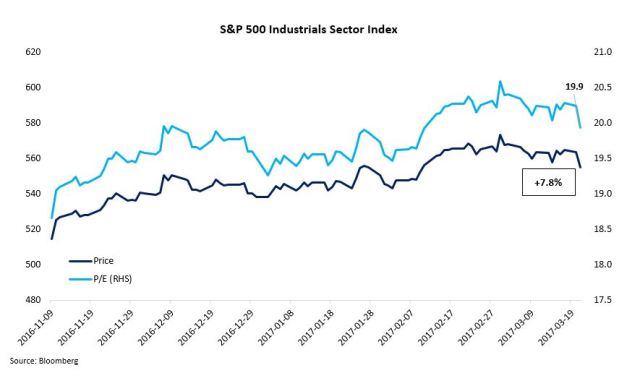

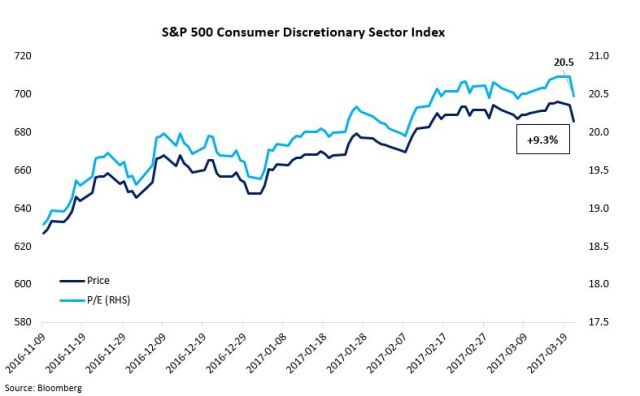

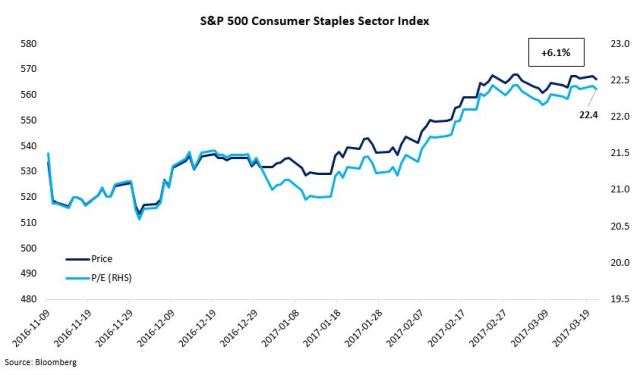

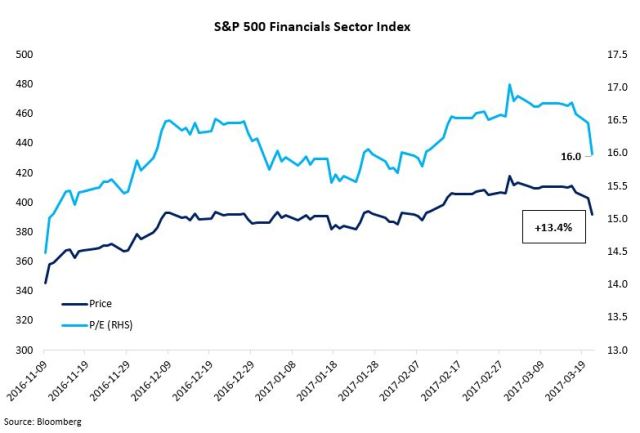

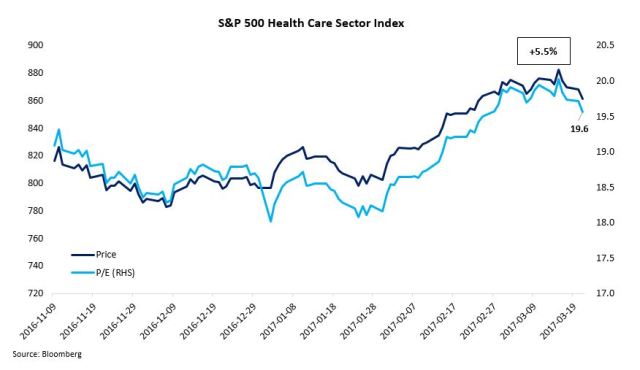

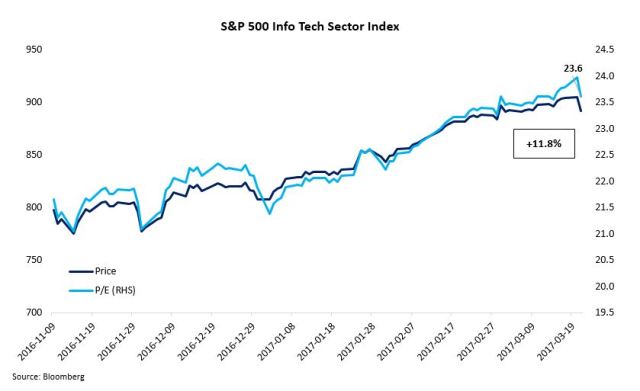

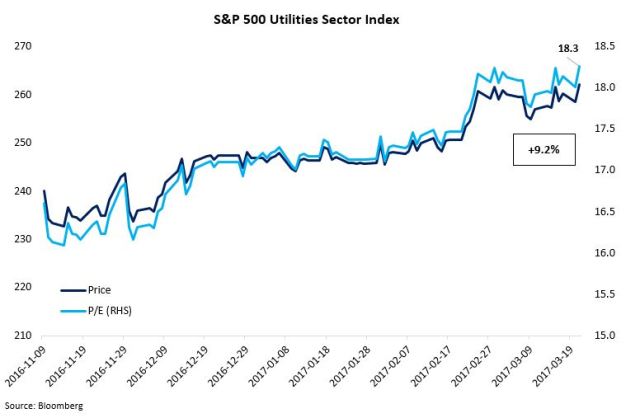

Final thought: How has S&P 500 fared by Sector thus far since election (as of March 21)? A few points to note:

1)Energy sector lags as investors remain cautious about the duration of OPEC production cut compliance, while the U.S. continues to increase its production.

2)Consumer product sectors and Health Care sector recover as border tax and drug price control discussions fade.

3)Financials sector continues to outperform, albeit recent pullback due to a “dovish” rate hike from the Fed as discussed last week.

4)Valuation wise (i.e.: P/E), Financials and Telecom sectors remain relatively attractive.

The week ahead: Bank of Canada Governor Stephen Poloz will speak on Tuesday (Mar 28); The U.K. is expected to trigger Article 50 on Wednesday (Mar 29); The U.S. will report revised Q4 GDP figures (Mar 30); Friday will be a busy day as 1)Japan will report its inflation and unemployment results, 2)China will release its Manufacturing PMI, 3)The U.K. will report its revised Q4 GDP figures, and 4)The eurozone will report its inflation data (Mar 31).

Tops News

Tops News Economic Calendar & News

Economic Calendar & News Economy

Economy

Market Commentary – March 24, 2017

The U.S. stock market traded mostly higher throughout the trading session but finished in the red after the Republicans decided to abruptly pull their health care bill on Friday as they failed to acquire enough votes to assure passage.

The Dow Jones industrial average dropped 59.86 points (-0.29%) to close at 20,596.72 as gains from Nike were offset by losses from Goldman Sachs and DuPont. The S&P 500 fell 1.98 points (-0.08%) to settle at 2,343.98, with Materials stocks lagging. The tech-heavy Nasdaq composite outperformed again and advanced 11.04 points (0.19%) to finish at 5,828.74. The stock market posted the worst week since election.

On Monday, FBI Director James Comey told Congress that FBI is investigating Trump’s link to Russia during the election period, and both Comey and NSA Director Mike Rogers stood by the conclusion that Russia attempted to influence the 2016 election in President Donald Trump’s favor. Here are a couple of excerpts of the testimony (full transcript).

On Tuesday, U.K. released its Consumer Prices Index (CPI) result for February, and it jumped to 2.3% (vs. 2.1% economist consensus surveyed by Reuters), up from 1.8% in January, the highest since Sep 2013. This is driven by rising food and fuel prices. Although the total pay growth (including bonus) rose 2.2% between the 3 months to January 2016 and the 3 months to January 2017, real pay growth (adjusted for inflation) increased by just 0.7%, the lowest since October 2014.

Will U.K. raise its interest rate earlier than it should, given the fact that the country’s inflation has surpassed the 2% target set out by the Bank of England? Note that as discussed last week, one of the nine voting members already voted for a rate hike during its latest rate setting meeting.

On Wednesday, the National Association of Realtors released the U.S. existing house sales figure, which dropped 3.7% for February to an annualized pace of 5.48 million units. This is driven by tight inventory and rising housing prices. Note that January’s sales pace was at 5.69 million units, the highest level since February 2007. On the other hand, U.S. new home sales reading came in strong and it is sitting at 592,000 units. It was the second highest since early 2008.

On Thursday, U.K. reported its February retail sales result, which grew 1.4% QoQ (vs. January 2017) and 3.7% YoY (vs. Feb 2016). However, the sustainability of this trend remains questionable considering higher import costs (due to weaker sterling), which will in turn leave households further squeezed by higher food and fuel prices, as mentioned above.

On Friday, U.S. President Donald Trump suffered a political setback and withdrew his healthcare bill after it failed to gain enough support to pass in Congress to repeal Obamacare, a major campaign promise of his and his allies. This reinforces the concern from the market participants that Republicans, which controls the House and the Senate, could not work together on one of its major priorities. Trump pointed out that he will go after tax reforms next during his remarks; however, the market remained hesitant to embrace his words and tumbled into the red to close for the week, as investors are concerned that the tax cut will be less than promised and the tax reform implementation will take much longer than expected.

Final thought: How has S&P 500 fared by Sector thus far since election (as of March 21)? A few points to note:

1)Energy sector lags as investors remain cautious about the duration of OPEC production cut compliance, while the U.S. continues to increase its production.

2)Consumer product sectors and Health Care sector recover as border tax and drug price control discussions fade.

3)Financials sector continues to outperform, albeit recent pullback due to a “dovish” rate hike from the Fed as discussed last week.

4)Valuation wise (i.e.: P/E), Financials and Telecom sectors remain relatively attractive.

The week ahead: Bank of Canada Governor Stephen Poloz will speak on Tuesday (Mar 28); The U.K. is expected to trigger Article 50 on Wednesday (Mar 29); The U.S. will report revised Q4 GDP figures (Mar 30); Friday will be a busy day as 1)Japan will report its inflation and unemployment results, 2)China will release its Manufacturing PMI, 3)The U.K. will report its revised Q4 GDP figures, and 4)The eurozone will report its inflation data (Mar 31).

Share this:

About AM_Journey

A small potato working on Bay Street