U.S. equities finished higher on Friday, as investors directed their attention to earnings season.

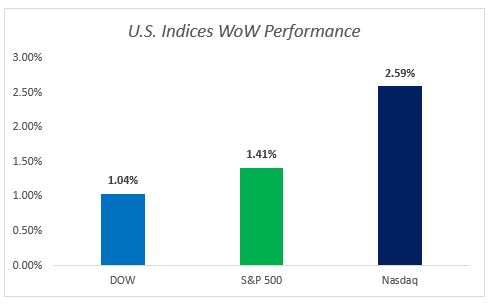

The Dow Jones industrial average climbed 84.65 points (0.39%) to close at 21,637.74, as losses from JPMorgan and Goldman Sachs were offset by gains from Microsoft and Apple. The S&P 500 reached another record level and advanced 11.44 points (0.47%) to settle at 2,459.27, led by the information technology sector. The Nasdaq composite outperformed again and rose 38.03 points (0.61%) to finish at 6,312.46. For the week as a whole, all three major stock indexes stayed in the green two weeks in a row, and Nasdaq outperformed the other two indexes.

On Monday, China reported both its consumer price index (CPI) and producer price index (PPI) in June, with the former rising 1.5% YoY (vs. 1.5% in May) and the latter increasing 5.5% YoY (vs. 5.5% in May). Both figures were in line with street consensus.

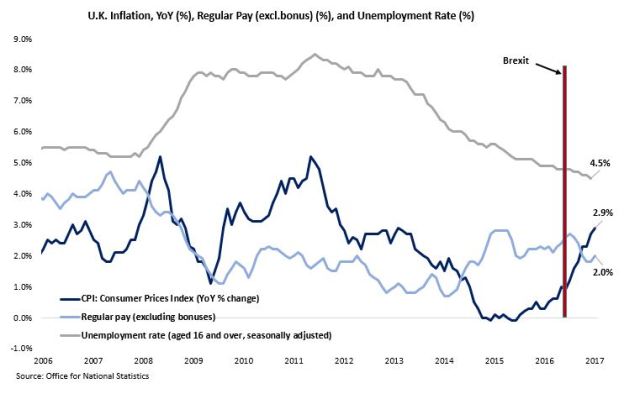

On Wednesday, official results from U.K.’s Official for National Statistics (ONS) pointed to an improved regular (excluding bonus) wage growth in the three months to May, which came in at 2.0% (vs. 1.8% in April). However, this remained below the elevated inflation rate, which is running above the Bank of England (BoE)’s 2% target at 2.9%. On the upside, the unemployment rate has fallen to 4.5% in the three months to May (vs. 4.6% in April), a 42-year low.

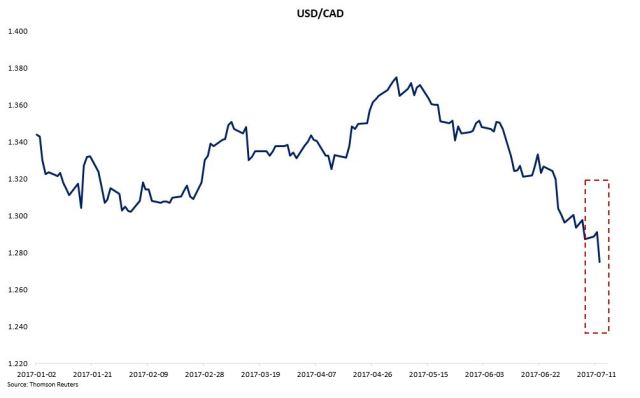

On to Canada, Bank of Canada (BoC) raised its overnight rate by 25 bps to 0.75%, its first increase in seven years. The rate hike was highly anticipated stemming from Governor Stephen Poloz’s remarks a couple weeks ago. BoC now sees the spare capacity has been absorbed quicker than expected, which provides the central bank with more comfort in raising its interest rate. Thus, BoC revised upward its economic growth figures to 2.8% (from 2.6%) and 2.0% (from 1.9%), for 2017 and 2018, respectively.

Additionally, Poloz downplayed concerns over soft inflation as he continued to believe the low inflation is transitory and it is attributable to the cost of energy and automobiles. As such, BoC revised down its inflation projection to 1.6% (from 1.9%) and 1.8% (from 2.0%), for 2017 and 2018, respectively.

With BoC’s hawkish tone in mind, the street has introduced the scenario of a second hike in October as the current base case, and the loonie enjoyed the best rally year to date and settled at 1.27 for the day.

After BoC’s rate increase decision, the big six Canadian banks followed suit by raising their prime rates by the full 25 bps to 2.95% on the same day. The prime rate serves as the the basis for a variety of loans with floating rates, and this will immediately result in additional borrowing costs on products such as variable-rate mortgages, home equity lines of credit, and other credit lines.

This chart shows the inflation-adjusted home prices for Canada and the U.S. How far could Canada’s housing market go amid rate hike cycle?

On to the U.S., Federal Reserve (Fed) Chair Janet Yellen testified on monetary policy before the House Financial Services Committee, as markets continued to digest the Fed’s recently announced balance sheet reduction plans. Yellen reiterated (excerpt below) that a tightening labor market would put upward pressure on wages and prices (i.e.: inflation), and she remained convinced that the recent soft inflation data was transitory. That said, she hedged herself by pointing out that the Fed could change course if inflation weakness proved more stubborn than expected.

The market nonetheless placed a 40% probability on another rate hike in December, according to the CME group.

Source: CME Group

Source: CME Group

On Thursday, Janet Yellen testified before the Congress and clarified a comment made a few weeks earlier regarding “there would be no financial crisis in our lifetime” by pointing out “we can never be confident that there won’t be another financial crisis. But it is important we maintain the improvements that have been put in place that mitigate the risk in the potential downturn”.

On the political front, Senate Republicans released a revised health care bill in an attempt to regain support from GOP members. However, the passage of the health bill remained questionable as two Republicans expressed immediate opposition (no Democrats are expected to support the bill either), putting Senate Majority Leader Mitch McConnell in a difficult position. As the U.S. debt ceiling discussion is approaching (i.e.: August – September) in the middle of a Fed tightening cycle, this is likely to exacerbate the political instability in Washington.

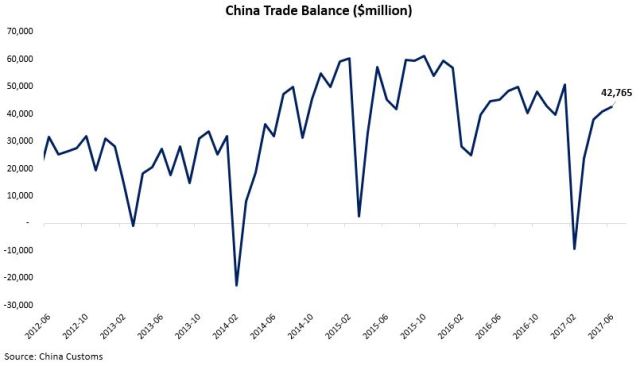

Additionally, China reported better-than-expected trade balance figures in June, with exports rising 11.3% YoY and imports increasing 17.2% YoY. The combination of strong foreign demand for Chinese goods and resilient domestic demand left China with a trade surplus of $42.77 billion in June.

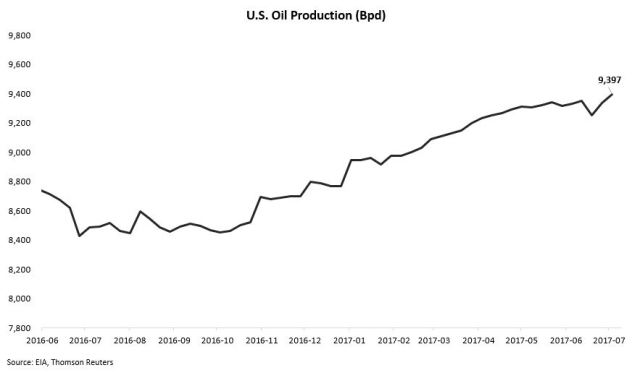

Further, International Energy Agency (IEA) stated OPEC’s compliance with production reduction dropped in June to its lowest levels in six months as several members secretly turned on the taps, thus delaying the re-balancing process in the oil market. OPEC’s compliance with cuts fell to 78% in June (vs. 95% in May) as higher-than-allowed output from Algeria, Ecuador, Gabon, Iraq, the UAE and Venezuela offset strong compliance from Saudi Arabia, Kuwait, Qatar and Angola.

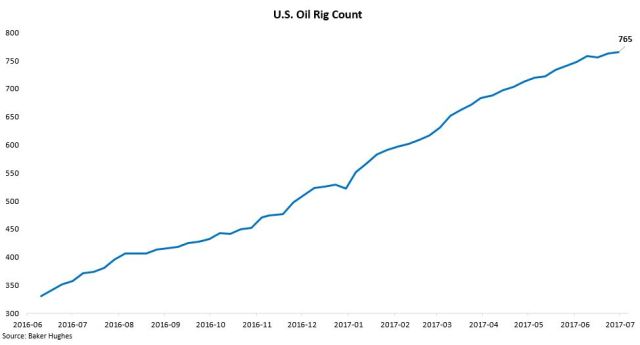

Similarly, U.S. oil production and rig count activities rose again after a one-week slowdown at the end of June. The July OPEC & Non-OPEC meeting shall provide more visibility with respect to the outlook of the oil market.

On Friday, U.S. reported its CPI in June, which came in at 0.2% MoM, unchanged against last month. The low inflation figure was largely due to lower cost of gasoline and mobile phone services. In addition, core CPI rose 0.1% in June, consistent with what was reported in the past three months. On a YoY basis, CPI rose 1.6% in June (vs. 1.9% in May) and core CPI grew 1.7% in June (vs. 1.7% in May). If soft inflation reading persists in the next few months, will the Fed slow down its pace of raising interest rates?

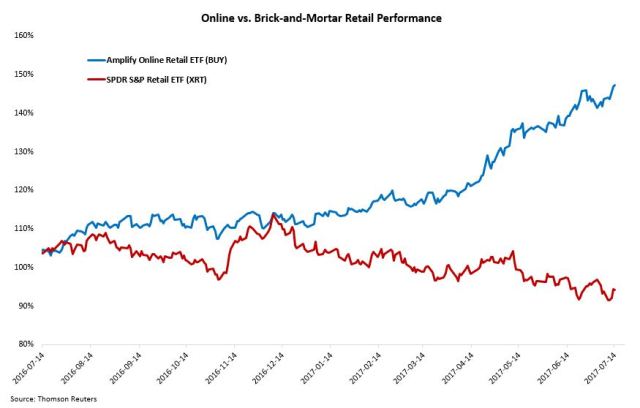

Also, U.S. Commerce Department reported a drop in retail sales for a second straight month in June, signaling soft domestic demand as consumers digested the ongoing transition related to moving from physical brick-and-mortar retail to online shopping. On a MoM basis, retail sales declined 0.2% in June (vs. -0.1% in May). Will we see a pick-up in consumer spending in the summer, which could subsequently spur inflation in the next few months?

Online retailers continue taking market share from traditional physical retailers.

Further, U.S. industrial production edged higher in June, thanks to gains from the materials sector. Industrial production rose 0.4% in June MoM (vs. 0.1% in May), largely driven by a 1.6% increase in mining output. On a YoY basis, industrial production grew 2.0% in June (vs. 1.9% in May).

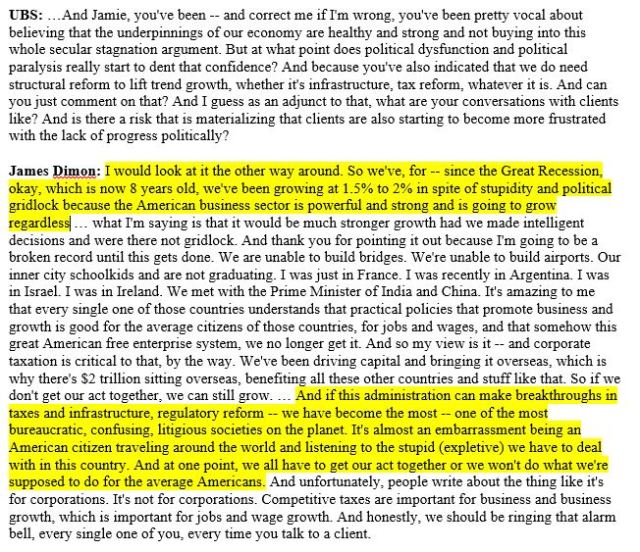

Lastly, JPMorgan CEO Jamie Dimon made headline during the Q2 2017 earnings conference call (JPM Q2 2017 Conference Call Transcript).

The week ahead: China will release its Q2 2017 GDP growth result and eurozone will report its CPI figures in June on Monday (Jul 17); U.K. will report its CPI reading in June on Tuesday (Jul 18); Bank of Japan will hold its interest rate decision meeting and U.S. will release its Housing Starts results in June on Wednesday (Jul 19); U.K. will report its retail sales result in June and European Central Bank will hold its interest rate decision meeting on Thursday (Jul 20); Canada will publish its CPI results in June and retail sales figures in May on Friday (Jul 21).

Tops News

Tops News Economic Calendar & News

Economic Calendar & News Economy

Economy

Market Commentary – July 14, 2017

U.S. equities finished higher on Friday, as investors directed their attention to earnings season.

The Dow Jones industrial average climbed 84.65 points (0.39%) to close at 21,637.74, as losses from JPMorgan and Goldman Sachs were offset by gains from Microsoft and Apple. The S&P 500 reached another record level and advanced 11.44 points (0.47%) to settle at 2,459.27, led by the information technology sector. The Nasdaq composite outperformed again and rose 38.03 points (0.61%) to finish at 6,312.46. For the week as a whole, all three major stock indexes stayed in the green two weeks in a row, and Nasdaq outperformed the other two indexes.

On Monday, China reported both its consumer price index (CPI) and producer price index (PPI) in June, with the former rising 1.5% YoY (vs. 1.5% in May) and the latter increasing 5.5% YoY (vs. 5.5% in May). Both figures were in line with street consensus.

On Wednesday, official results from U.K.’s Official for National Statistics (ONS) pointed to an improved regular (excluding bonus) wage growth in the three months to May, which came in at 2.0% (vs. 1.8% in April). However, this remained below the elevated inflation rate, which is running above the Bank of England (BoE)’s 2% target at 2.9%. On the upside, the unemployment rate has fallen to 4.5% in the three months to May (vs. 4.6% in April), a 42-year low.

On to Canada, Bank of Canada (BoC) raised its overnight rate by 25 bps to 0.75%, its first increase in seven years. The rate hike was highly anticipated stemming from Governor Stephen Poloz’s remarks a couple weeks ago. BoC now sees the spare capacity has been absorbed quicker than expected, which provides the central bank with more comfort in raising its interest rate. Thus, BoC revised upward its economic growth figures to 2.8% (from 2.6%) and 2.0% (from 1.9%), for 2017 and 2018, respectively.

Additionally, Poloz downplayed concerns over soft inflation as he continued to believe the low inflation is transitory and it is attributable to the cost of energy and automobiles. As such, BoC revised down its inflation projection to 1.6% (from 1.9%) and 1.8% (from 2.0%), for 2017 and 2018, respectively.

With BoC’s hawkish tone in mind, the street has introduced the scenario of a second hike in October as the current base case, and the loonie enjoyed the best rally year to date and settled at 1.27 for the day.

After BoC’s rate increase decision, the big six Canadian banks followed suit by raising their prime rates by the full 25 bps to 2.95% on the same day. The prime rate serves as the the basis for a variety of loans with floating rates, and this will immediately result in additional borrowing costs on products such as variable-rate mortgages, home equity lines of credit, and other credit lines.

This chart shows the inflation-adjusted home prices for Canada and the U.S. How far could Canada’s housing market go amid rate hike cycle?

On to the U.S., Federal Reserve (Fed) Chair Janet Yellen testified on monetary policy before the House Financial Services Committee, as markets continued to digest the Fed’s recently announced balance sheet reduction plans. Yellen reiterated (excerpt below) that a tightening labor market would put upward pressure on wages and prices (i.e.: inflation), and she remained convinced that the recent soft inflation data was transitory. That said, she hedged herself by pointing out that the Fed could change course if inflation weakness proved more stubborn than expected.

The market nonetheless placed a 40% probability on another rate hike in December, according to the CME group.

On Thursday, Janet Yellen testified before the Congress and clarified a comment made a few weeks earlier regarding “there would be no financial crisis in our lifetime” by pointing out “we can never be confident that there won’t be another financial crisis. But it is important we maintain the improvements that have been put in place that mitigate the risk in the potential downturn”.

On the political front, Senate Republicans released a revised health care bill in an attempt to regain support from GOP members. However, the passage of the health bill remained questionable as two Republicans expressed immediate opposition (no Democrats are expected to support the bill either), putting Senate Majority Leader Mitch McConnell in a difficult position. As the U.S. debt ceiling discussion is approaching (i.e.: August – September) in the middle of a Fed tightening cycle, this is likely to exacerbate the political instability in Washington.

Additionally, China reported better-than-expected trade balance figures in June, with exports rising 11.3% YoY and imports increasing 17.2% YoY. The combination of strong foreign demand for Chinese goods and resilient domestic demand left China with a trade surplus of $42.77 billion in June.

Further, International Energy Agency (IEA) stated OPEC’s compliance with production reduction dropped in June to its lowest levels in six months as several members secretly turned on the taps, thus delaying the re-balancing process in the oil market. OPEC’s compliance with cuts fell to 78% in June (vs. 95% in May) as higher-than-allowed output from Algeria, Ecuador, Gabon, Iraq, the UAE and Venezuela offset strong compliance from Saudi Arabia, Kuwait, Qatar and Angola.

Similarly, U.S. oil production and rig count activities rose again after a one-week slowdown at the end of June. The July OPEC & Non-OPEC meeting shall provide more visibility with respect to the outlook of the oil market.

On Friday, U.S. reported its CPI in June, which came in at 0.2% MoM, unchanged against last month. The low inflation figure was largely due to lower cost of gasoline and mobile phone services. In addition, core CPI rose 0.1% in June, consistent with what was reported in the past three months. On a YoY basis, CPI rose 1.6% in June (vs. 1.9% in May) and core CPI grew 1.7% in June (vs. 1.7% in May). If soft inflation reading persists in the next few months, will the Fed slow down its pace of raising interest rates?

Also, U.S. Commerce Department reported a drop in retail sales for a second straight month in June, signaling soft domestic demand as consumers digested the ongoing transition related to moving from physical brick-and-mortar retail to online shopping. On a MoM basis, retail sales declined 0.2% in June (vs. -0.1% in May). Will we see a pick-up in consumer spending in the summer, which could subsequently spur inflation in the next few months?

Online retailers continue taking market share from traditional physical retailers.

Further, U.S. industrial production edged higher in June, thanks to gains from the materials sector. Industrial production rose 0.4% in June MoM (vs. 0.1% in May), largely driven by a 1.6% increase in mining output. On a YoY basis, industrial production grew 2.0% in June (vs. 1.9% in May).

Lastly, JPMorgan CEO Jamie Dimon made headline during the Q2 2017 earnings conference call (JPM Q2 2017 Conference Call Transcript).

The week ahead: China will release its Q2 2017 GDP growth result and eurozone will report its CPI figures in June on Monday (Jul 17); U.K. will report its CPI reading in June on Tuesday (Jul 18); Bank of Japan will hold its interest rate decision meeting and U.S. will release its Housing Starts results in June on Wednesday (Jul 19); U.K. will report its retail sales result in June and European Central Bank will hold its interest rate decision meeting on Thursday (Jul 20); Canada will publish its CPI results in June and retail sales figures in May on Friday (Jul 21).

Share this:

About AM_Journey

A small potato working on Bay Street