U.S. equities closed mixed on Friday as investors assessed the nation’s Q2 GDP result.

The Dow Jones industrial average finished at record high, up 33.76 points (0.15%) to close at 21,830.31, as investors looked past Amazon Q2 earnings results (beat revenue, but missed on bottom line). The S&P 500 fell 3.32 points (-0.13%) to settle at 2,472.10, led by consumer staples sector. The Nasdaq composite slipped 7.51 points (-0.12%) to finish at 6,374.68, as losses from Amazon were partially offset by gains from Facebook, Netflix, and Alphabet. For the week as a whole, Dow Jones moved into the green and outperformed the other indices, while S&P 500 and Nasdaq fell back into the red.

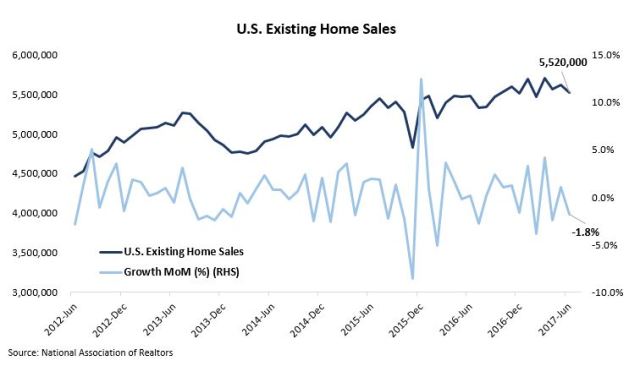

On Monday, U.S. existing home sales dropped 1.8% in June MoM (vs. gains of 1.1% in May), to a seasonally adjusted annual rate of 5.52 million, driven by solid demand relative to the continued tight supply of existing homes.

On Tuesday, the Conference Board reported its U.S. consumer confidence index, which grew to 121.1 in July (vs. 117.3 in June), coming in as the second highest reading since 2000. The index in March had hit 124.9, its highest level since December 2000, but has subsided in recent months.

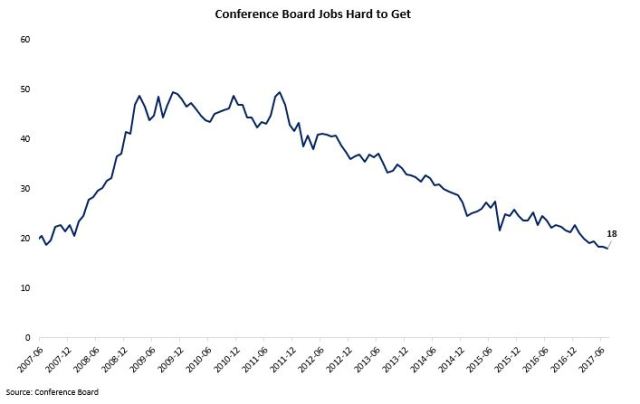

The main reason Americans are optimistic about the economy is jobs as the labor market continued to strengthen. The index below shows the proportion of survey participants who think jobs are “hard to get” (a lower number means easier to obtain jobs).

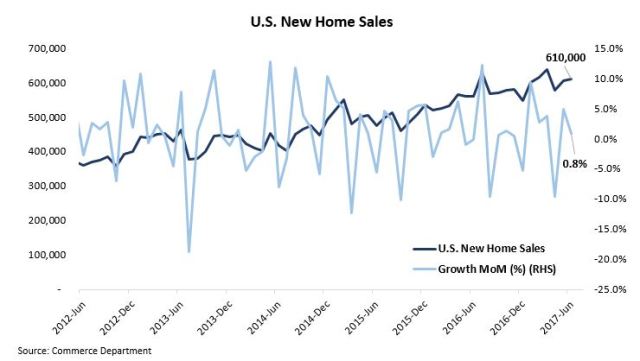

On Wednesday, U.S. new home sales rose 0.8% in June MoM (vs. 4.9% in May) to a seasonally annualized rate of 610,000.

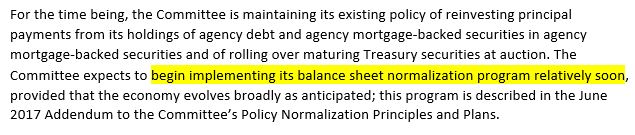

In addition, the Federal Reserve (Fed) concluded its two-day FOMC meeting (full statement) and signaled it is ready to start gradually shrinking its $4.5 trillion balance sheet as soon as in September, while holding its federal funds rate steady between 1.00 to 1.25%. See key excerpt below.

Further, seven GOP senators and all Democrats voted against (result: 45-55) repealing ObamaCare with a two-year delay to allow lawmakers to craft a replacement. This continued to put the Trump administration in a tough spot as it has to seek alternative avenue to achieve the 50 votes to move forward on a health care reform legislation (be reminded that a failure to repeal ObamaCare and replace with a more economical health care plan will have adverse impact on the subsequent implementation of Trump’s pro-growth initiatives, such as tax reform and infrastructure spending).

On Thursday, U.S. reported encouraging durable goods orders results in June, which grew 6.5% MoM, reversing the declines from the previous two months. This result registered the biggest increase since July 2014. The bulk of the increase was mainly driven by aircraft business, which jumped 131.2% MoM.

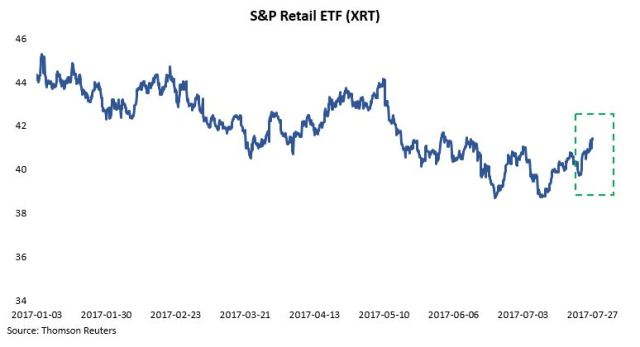

Additionally, retailer stocks rallied on the announcement from the Republicans, who stated that they have decided to give up on pursuing the border adjustment tax (BAT).

On Friday, U.S. reported Q2 GDP growth figure, coming in at 2.6%, slightly lower than the 2.7% street consensus. Meanwhile, Q1 GDP was revised lower to 1.2% (from 1.4% reported previously).

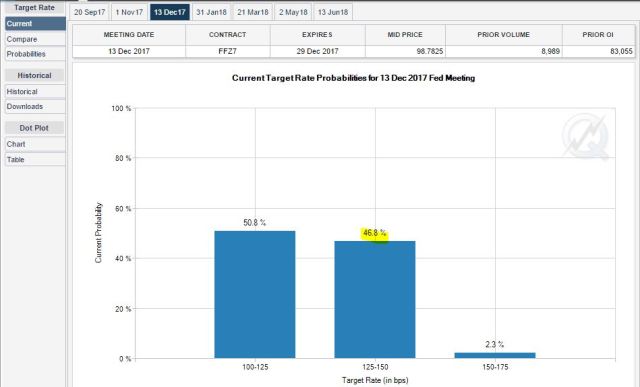

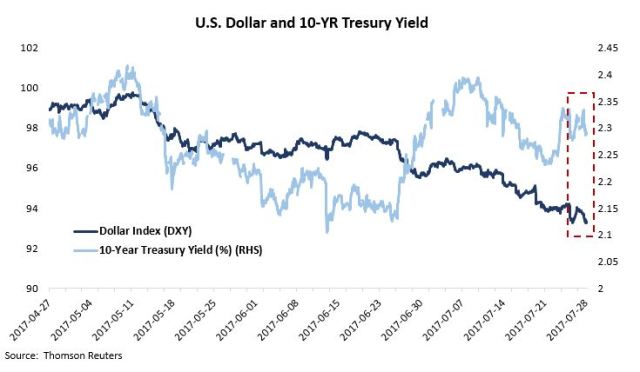

The weaker than expected GDP growth reading sent both the dollar and the 10-year treasury yield to the south as investors placed odds of less than 50% on a rate hike in December, according to CME Group.

On to Canada, the nation’s GDP rose 0.6% in May MoM, marking the seventh consecutive gains. On a YoY basis, the economy has expanded 4.6%, the biggest increase since 2000. This robust economic data would help position the Bank of Canada for another rate hike in October. As such, the Canadian dollar jumped about 0.9% against the U.S. dollar after the announcement.

The week ahead: China will release Manufacturing purchasing managers’ index (PMI) result in July, and eurozone will report unemployment rate and consumer price index (CPI) readings in July on Monday (Jul 31); U.S. will publish its July ISM Manufacturing PMI figure and eurozone will release its preliminary Q2 GDP reading on Tuesday (Aug 1); U.S. will report its ADP Nonfarm employment result in July on Wednesday (Aug 2); U.K. will report its July CPI and Services PMI, meanwhile, Bank of England will hold its interest rate decision meeting on Thursday (Aug 3); U.S. will release its non-farm payrolls result in July on Friday (Aug 4).

Tops News

Tops News Economic Calendar & News

Economic Calendar & News Economy

Economy

Market Commentary – July 28, 2017

U.S. equities closed mixed on Friday as investors assessed the nation’s Q2 GDP result.

The Dow Jones industrial average finished at record high, up 33.76 points (0.15%) to close at 21,830.31, as investors looked past Amazon Q2 earnings results (beat revenue, but missed on bottom line). The S&P 500 fell 3.32 points (-0.13%) to settle at 2,472.10, led by consumer staples sector. The Nasdaq composite slipped 7.51 points (-0.12%) to finish at 6,374.68, as losses from Amazon were partially offset by gains from Facebook, Netflix, and Alphabet. For the week as a whole, Dow Jones moved into the green and outperformed the other indices, while S&P 500 and Nasdaq fell back into the red.

On Monday, U.S. existing home sales dropped 1.8% in June MoM (vs. gains of 1.1% in May), to a seasonally adjusted annual rate of 5.52 million, driven by solid demand relative to the continued tight supply of existing homes.

On Tuesday, the Conference Board reported its U.S. consumer confidence index, which grew to 121.1 in July (vs. 117.3 in June), coming in as the second highest reading since 2000. The index in March had hit 124.9, its highest level since December 2000, but has subsided in recent months.

The main reason Americans are optimistic about the economy is jobs as the labor market continued to strengthen. The index below shows the proportion of survey participants who think jobs are “hard to get” (a lower number means easier to obtain jobs).

On Wednesday, U.S. new home sales rose 0.8% in June MoM (vs. 4.9% in May) to a seasonally annualized rate of 610,000.

In addition, the Federal Reserve (Fed) concluded its two-day FOMC meeting (full statement) and signaled it is ready to start gradually shrinking its $4.5 trillion balance sheet as soon as in September, while holding its federal funds rate steady between 1.00 to 1.25%. See key excerpt below.

Further, seven GOP senators and all Democrats voted against (result: 45-55) repealing ObamaCare with a two-year delay to allow lawmakers to craft a replacement. This continued to put the Trump administration in a tough spot as it has to seek alternative avenue to achieve the 50 votes to move forward on a health care reform legislation (be reminded that a failure to repeal ObamaCare and replace with a more economical health care plan will have adverse impact on the subsequent implementation of Trump’s pro-growth initiatives, such as tax reform and infrastructure spending).

On Thursday, U.S. reported encouraging durable goods orders results in June, which grew 6.5% MoM, reversing the declines from the previous two months. This result registered the biggest increase since July 2014. The bulk of the increase was mainly driven by aircraft business, which jumped 131.2% MoM.

Additionally, retailer stocks rallied on the announcement from the Republicans, who stated that they have decided to give up on pursuing the border adjustment tax (BAT).

On Friday, U.S. reported Q2 GDP growth figure, coming in at 2.6%, slightly lower than the 2.7% street consensus. Meanwhile, Q1 GDP was revised lower to 1.2% (from 1.4% reported previously).

The weaker than expected GDP growth reading sent both the dollar and the 10-year treasury yield to the south as investors placed odds of less than 50% on a rate hike in December, according to CME Group.

On to Canada, the nation’s GDP rose 0.6% in May MoM, marking the seventh consecutive gains. On a YoY basis, the economy has expanded 4.6%, the biggest increase since 2000. This robust economic data would help position the Bank of Canada for another rate hike in October. As such, the Canadian dollar jumped about 0.9% against the U.S. dollar after the announcement.

The week ahead: China will release Manufacturing purchasing managers’ index (PMI) result in July, and eurozone will report unemployment rate and consumer price index (CPI) readings in July on Monday (Jul 31); U.S. will publish its July ISM Manufacturing PMI figure and eurozone will release its preliminary Q2 GDP reading on Tuesday (Aug 1); U.S. will report its ADP Nonfarm employment result in July on Wednesday (Aug 2); U.K. will report its July CPI and Services PMI, meanwhile, Bank of England will hold its interest rate decision meeting on Thursday (Aug 3); U.S. will release its non-farm payrolls result in July on Friday (Aug 4).

Share this:

About AM_Journey

A small potato working on Bay Street