U.S. stock market finished higher as investors digested geopolitical tensions between the U.S. and North Korea.

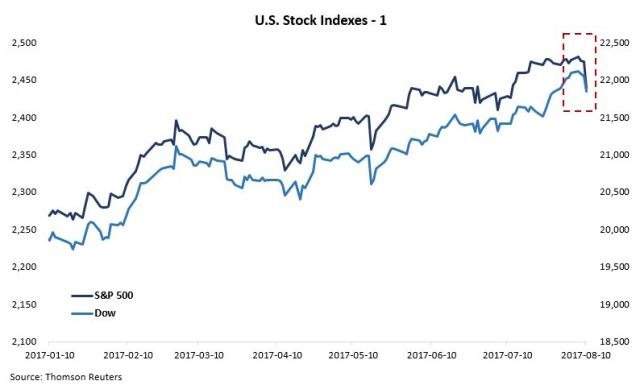

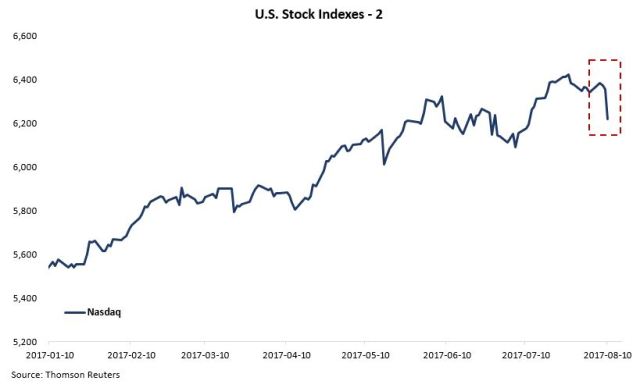

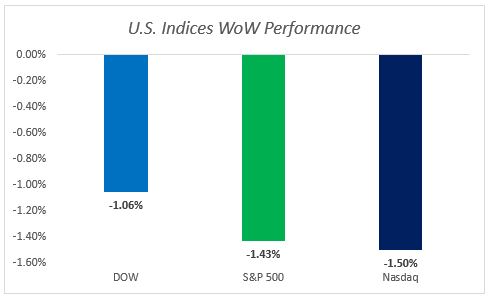

The Dow Jones industrial average rose 14.31 points (0.07%) to settle at 21,858.32 with Apple contributing the most gains. The S&P 500 gained 3.11 points (0.13%) to close at 2,441.32, mostly driven by info tech stocks. The Nasdaq composite outperformed and jumped by 39.68 points (0.64%) to finish at 6,256.56, led by tech stocks. For the week as a whole, all U.S. stock indexes fell back into the red as tensions between the U.S. and North Korea continued to escalate.

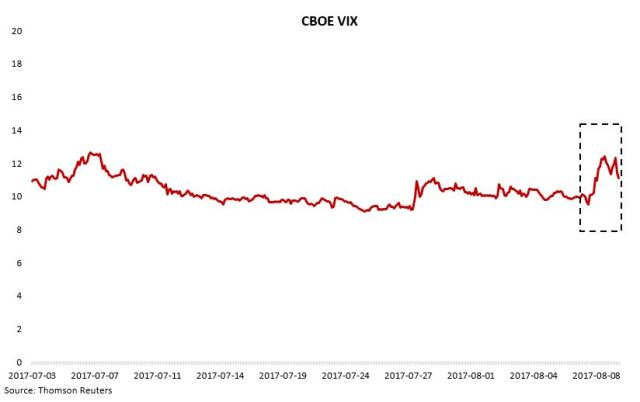

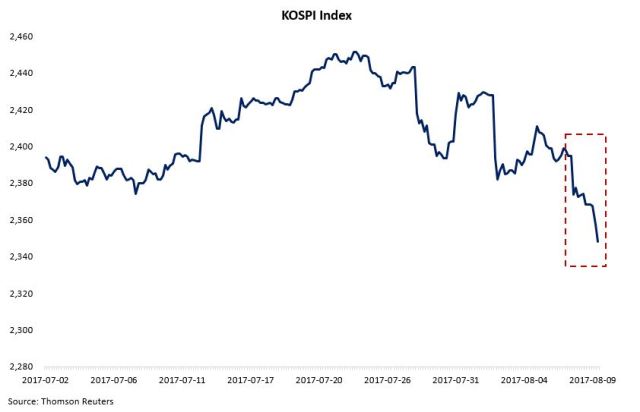

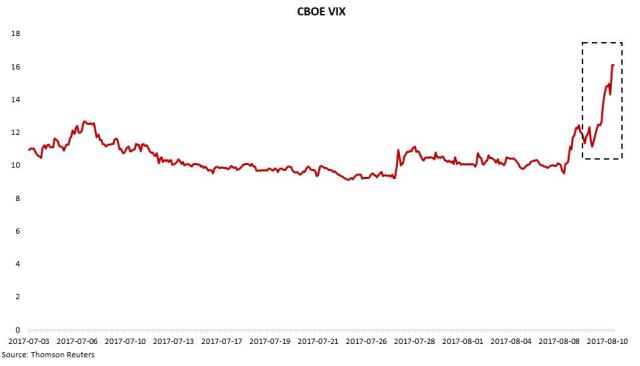

On Tuesday, in response to the increasingly threatening military buildup in North Korea, President Donald Trump declared the “U.S. is ready to respond with fire and fury”. Yet, North Korea disregarded Trump’s warning and disclosed a detailed plan related to launching ballistic missiles towards Guam (U.S. pacific territory). As a result, VIX spiked while South Korea stock index retreated.

On Wednesday, China reported both the Consumer Price Index (CPI) and the Producer Price Index (PPI) in July, both coming in slightly below the street consensus. China’s inflation grew 1.4% YoY in July (vs. 1.5% in June), mostly driven by lower food prices, while the nation’s 5.5% expansion in PPI was attributable to the growth in the steel and mineral industries.

On Thursday, President Donald Trump escalated his rhetoric on North Korea by stating his previous warning of bringing “fire and fury” to North Korea may not be tough enough. Major U.S. stock indexes dived and VIX jumped further.

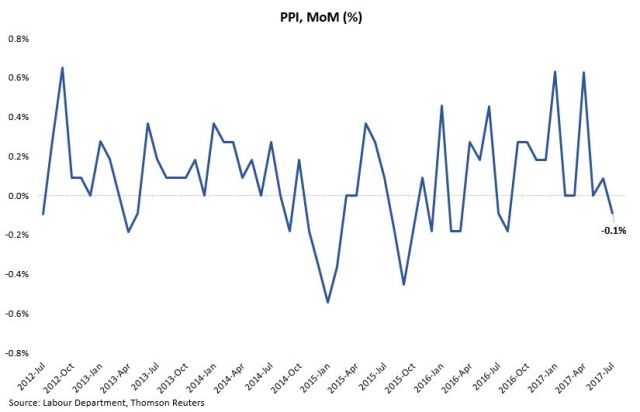

In addition, U.S. registered its first decline in its PPI reading, which dropped 0.1% MoM in July (vs. 0.1% gains in June), due to decreasing costs for services. Further moderation in industrial inflation could point to a potential delay in interest rate hike by the Federal Reserve.

On Friday, U.S. CPI came in at 1.7% YoY in July (vs. 1.6% in June), shy of the street consensus of 1.8%. Excluding the volatile food and energy prices, core CPI remained at 1.7% in July since May. Despite the slightly improvement in headline inflation, the soft reading could continue to worry the Federal Reserve officials who insisted the weak price data is transitory.

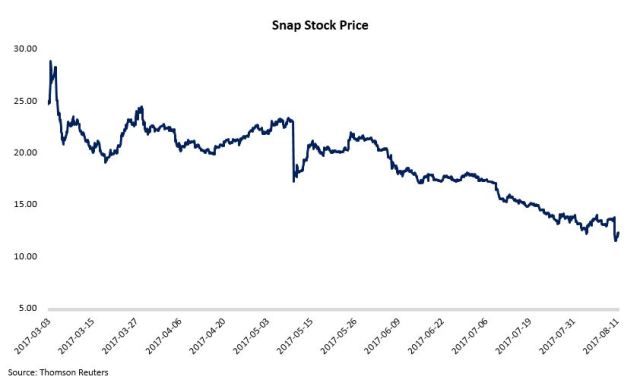

Additionally, Snap Inc. reported another disappointing quarterly earnings result, as the company fell short of analyst expectations for both its top- and bottom-line, and struggled to acquire more users. The weak earnings result combined with the company’s reluctance to provide guidance sent its share price down by more than 13%. Note that Snap’s share price has been trading below its IPO price of $17 for over a month.

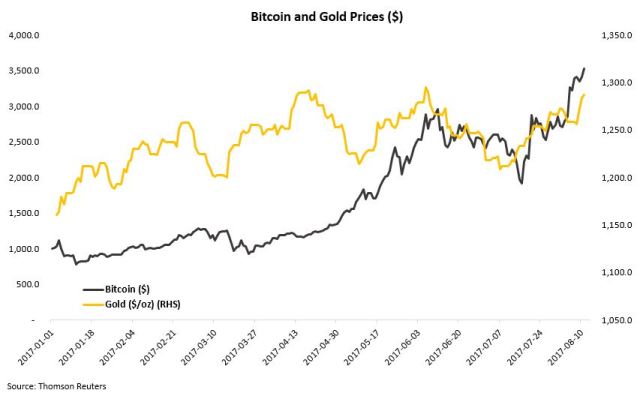

On the other hand, investors continued to flock to Bitcoin and Gold amid intensifying geopolitical concerns in North Korea.

To close the week, here is an interesting article on what artificial intelligence could mean to us by 2030.

The week ahead: Japan will report its Q2 GDP result and China will release its July retail sales and industrial production data on Monday (Aug 14); U.K. will release its July CPI reading and U.S. will report its July retail sales result on Tuesday (Aug 15); U.S. will publish its housing starts and building permits in July on Wednesday (Aug 16); U.K. will report its retail sales result in July and eurozone will release its July CPI on Thursday (Aug 17); Canada will release its CPI on Friday (Aug 18).

About AM_Journey

A small potato working on Bay Street

Tops News

Tops News Economic Calendar & News

Economic Calendar & News Economy

Economy

Market Commentary – August 11, 2017

U.S. stock market finished higher as investors digested geopolitical tensions between the U.S. and North Korea.

The Dow Jones industrial average rose 14.31 points (0.07%) to settle at 21,858.32 with Apple contributing the most gains. The S&P 500 gained 3.11 points (0.13%) to close at 2,441.32, mostly driven by info tech stocks. The Nasdaq composite outperformed and jumped by 39.68 points (0.64%) to finish at 6,256.56, led by tech stocks. For the week as a whole, all U.S. stock indexes fell back into the red as tensions between the U.S. and North Korea continued to escalate.

On Tuesday, in response to the increasingly threatening military buildup in North Korea, President Donald Trump declared the “U.S. is ready to respond with fire and fury”. Yet, North Korea disregarded Trump’s warning and disclosed a detailed plan related to launching ballistic missiles towards Guam (U.S. pacific territory). As a result, VIX spiked while South Korea stock index retreated.

On Wednesday, China reported both the Consumer Price Index (CPI) and the Producer Price Index (PPI) in July, both coming in slightly below the street consensus. China’s inflation grew 1.4% YoY in July (vs. 1.5% in June), mostly driven by lower food prices, while the nation’s 5.5% expansion in PPI was attributable to the growth in the steel and mineral industries.

On Thursday, President Donald Trump escalated his rhetoric on North Korea by stating his previous warning of bringing “fire and fury” to North Korea may not be tough enough. Major U.S. stock indexes dived and VIX jumped further.

In addition, U.S. registered its first decline in its PPI reading, which dropped 0.1% MoM in July (vs. 0.1% gains in June), due to decreasing costs for services. Further moderation in industrial inflation could point to a potential delay in interest rate hike by the Federal Reserve.

On Friday, U.S. CPI came in at 1.7% YoY in July (vs. 1.6% in June), shy of the street consensus of 1.8%. Excluding the volatile food and energy prices, core CPI remained at 1.7% in July since May. Despite the slightly improvement in headline inflation, the soft reading could continue to worry the Federal Reserve officials who insisted the weak price data is transitory.

Additionally, Snap Inc. reported another disappointing quarterly earnings result, as the company fell short of analyst expectations for both its top- and bottom-line, and struggled to acquire more users. The weak earnings result combined with the company’s reluctance to provide guidance sent its share price down by more than 13%. Note that Snap’s share price has been trading below its IPO price of $17 for over a month.

On the other hand, investors continued to flock to Bitcoin and Gold amid intensifying geopolitical concerns in North Korea.

To close the week, here is an interesting article on what artificial intelligence could mean to us by 2030.

The week ahead: Japan will report its Q2 GDP result and China will release its July retail sales and industrial production data on Monday (Aug 14); U.K. will release its July CPI reading and U.S. will report its July retail sales result on Tuesday (Aug 15); U.S. will publish its housing starts and building permits in July on Wednesday (Aug 16); U.K. will report its retail sales result in July and eurozone will release its July CPI on Thursday (Aug 17); Canada will release its CPI on Friday (Aug 18).

Share this:

About AM_Journey

A small potato working on Bay Street