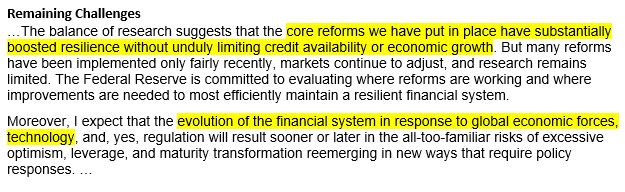

U.S. stocks closed mixed on Friday, as investors digested speeches by Federal Reserve Chair Janet Yellen and European Central Bank President Mario Draghi at the Jackson Hole Economic Policy Symposium.

The Dow Jones industrial average was up 30.27 points (0.14%) to close at 21,813.67, primarily driven by gains in IBM and Home Depot stocks. The S&P 500 rose 4.08 points (0.17%) to finish at 2,443.05, with energy and telecom stocks contributing to the most gains. On the other hand, the tech-heavy Nasdaq composite dropped 5.68 points (-0.09%) to settle at 6,265.64. For the week as a whole, major U.S. stock indexes emerged from the two-week losses and moved into the green, with Nasdaq composite outperforming the others.

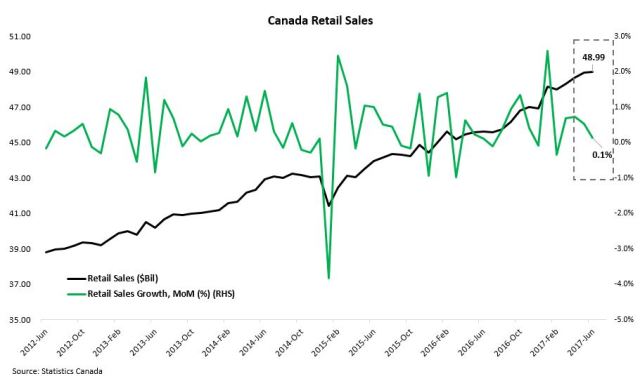

On Tuesday, Canada reported soft retail sales data, with MoM growth coming in at 0.1% in June (vs. 0.5% in May), below street expectations of 0.3%. Nonetheless, through June, retail sales has been consistently registering positive MoM growth with the exception of February. The relative economic resilience witnessed in Canada has encouraged Bank of Canada to hike its overnight rate in July. Will retail sales growth recede into the second half of 2017, after the subsequent data releases incorporate the impact of rate increase?

On to the U.S., the markets were not pleased by one of Trump’s remarks in Arizona stating “If we have to close down our government, we’re building that wall”. Major stock futures were trading lower after the announcement.

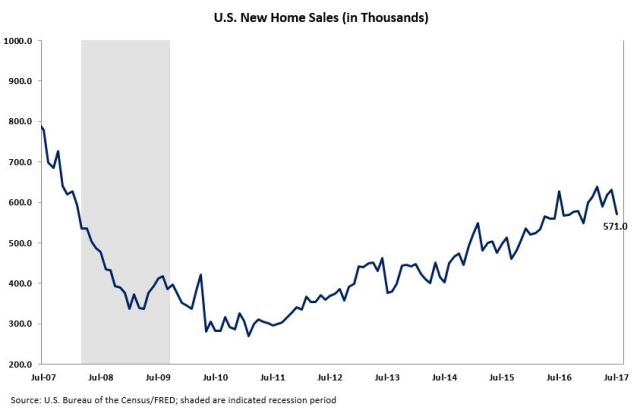

On Wednesday, U.S. new home sales surprised to the downside and dropped 9.4% MoM to an annualized rate of 571,000 units in July (vs. 630,000 units in June), the lowest in 2017. The tight inventory combined with rising home prices continued to limit housing activities.

In addition, eurozone’s manufacturing Purchasing Managers’ Index (PMI) rose to 57.4 in August (vs. 56.6 in July), the highest since 2011, driven by strong growth in output and new orders sub-sectors, according to Markit. On the other hand, services PMI in eurozone fell to 54.9 in August after standing flat at 55.4 since June due to a slowdown in services activity and employment.

On Thursday, U.S. existing home sales unexpectedly fell to the lowest level thus far in 2017 for the similar reason mentioned above for new home sales. The reading dropped 1.3% MoM, to an annualized rate of 5.44 million in July (vs. 5.51 million in June), below street consensus of a 0.9% increase.

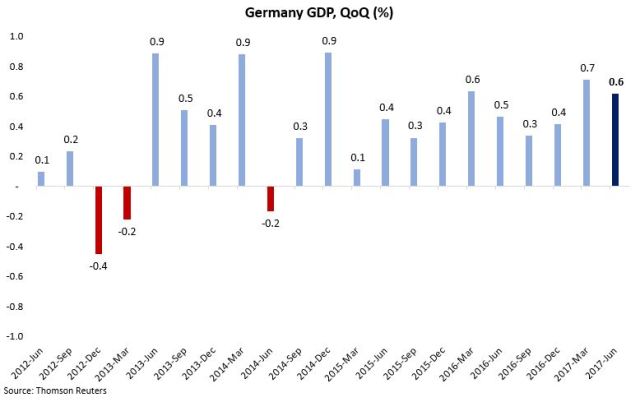

On Friday, Germany’s Q2 GDP grew by 0.6% QoQ (vs. 0.7% in Q1 GDP), translating into an annualized rate of 2.1%. The economic growth was underpinned by both household and government expenditure. Should the strong first half momentum carry into the remainder of 2017, will it accelerate the case for tapering the asset purchases program, as far as the European Central Bank (ECB) is concerned?

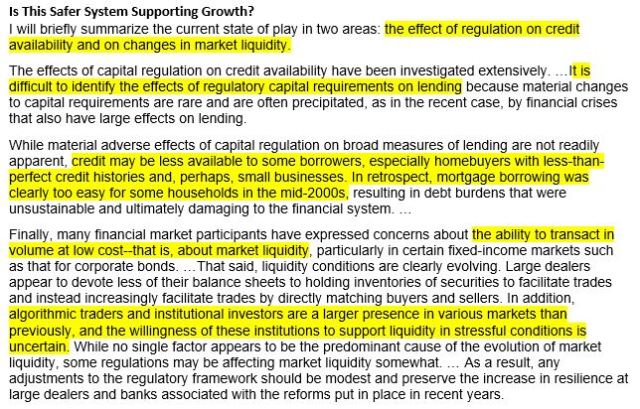

Speaking about tapering, during the economic symposium in Jackson Hole, Wyoming, Federal Reserve Chair Janet Yellen defended and elaborated on the net benefits of enacting financial regulations. Nonetheless, she discussed neither the economic outlook nor monetary policy in her speech (Source: FRB). See below excerpts.

Investors were not impressed by Yellen’s speech as they expected more color surrounding the subject of balance sheet reduction.

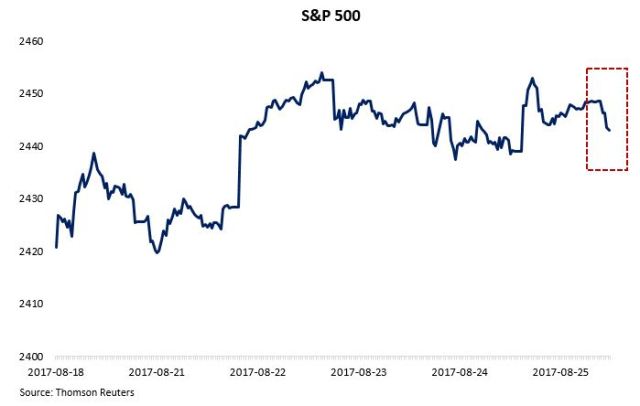

Gold futures received a boost amid continued uncertainty in monetary policy coupled with political instability in the White House.

The yield on U.S. 10-Year Treasury note fell accordingly.

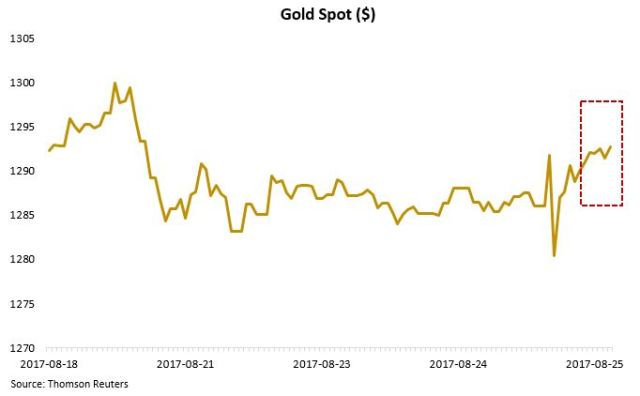

The ECB President Mario Draghi subsequently delivered his speech, which was uneventful as well. His tone was deemed neither hawkish nor dovish, and he strove to avoid specific discussions on current market conditions and the tapering of ECB’s bond purchases program, before the quantitative tightening messages, which are expected to be delivered throughout the rest of 2017. Euro rose to the highest level against the greenback since early January 2015.

Lastly, here is a decent write-up pertaining to the macroeconomic outlook as well as the corresponding asset allocation suggested by PIMCO. (Source: PIMCO).

The week ahead: U.S. will release its August consumer confidence reading on Tuesday (Aug 29); China will publish its official manufacturing PMI in August and U.S. will release its revised Q2 GDP on Wednesday (Aug 30); China will report its Caixin manufacturing PMI in August, U.S. will release its July pending home sales, the eurozone will publish its inflation data and unemployment rate, and Canada will release Q2 2017 GDP results on Thursday (Aug 31); U.S. will report its nonfarm payrolls, unemployment rate, and manufacturing PMI in August (Sep 1).

Tops News

Tops News Economic Calendar & News

Economic Calendar & News Economy

Economy

Market Commentary – August 25, 2017

U.S. stocks closed mixed on Friday, as investors digested speeches by Federal Reserve Chair Janet Yellen and European Central Bank President Mario Draghi at the Jackson Hole Economic Policy Symposium.

The Dow Jones industrial average was up 30.27 points (0.14%) to close at 21,813.67, primarily driven by gains in IBM and Home Depot stocks. The S&P 500 rose 4.08 points (0.17%) to finish at 2,443.05, with energy and telecom stocks contributing to the most gains. On the other hand, the tech-heavy Nasdaq composite dropped 5.68 points (-0.09%) to settle at 6,265.64. For the week as a whole, major U.S. stock indexes emerged from the two-week losses and moved into the green, with Nasdaq composite outperforming the others.

On Tuesday, Canada reported soft retail sales data, with MoM growth coming in at 0.1% in June (vs. 0.5% in May), below street expectations of 0.3%. Nonetheless, through June, retail sales has been consistently registering positive MoM growth with the exception of February. The relative economic resilience witnessed in Canada has encouraged Bank of Canada to hike its overnight rate in July. Will retail sales growth recede into the second half of 2017, after the subsequent data releases incorporate the impact of rate increase?

On to the U.S., the markets were not pleased by one of Trump’s remarks in Arizona stating “If we have to close down our government, we’re building that wall”. Major stock futures were trading lower after the announcement.

On Wednesday, U.S. new home sales surprised to the downside and dropped 9.4% MoM to an annualized rate of 571,000 units in July (vs. 630,000 units in June), the lowest in 2017. The tight inventory combined with rising home prices continued to limit housing activities.

In addition, eurozone’s manufacturing Purchasing Managers’ Index (PMI) rose to 57.4 in August (vs. 56.6 in July), the highest since 2011, driven by strong growth in output and new orders sub-sectors, according to Markit. On the other hand, services PMI in eurozone fell to 54.9 in August after standing flat at 55.4 since June due to a slowdown in services activity and employment.

On Thursday, U.S. existing home sales unexpectedly fell to the lowest level thus far in 2017 for the similar reason mentioned above for new home sales. The reading dropped 1.3% MoM, to an annualized rate of 5.44 million in July (vs. 5.51 million in June), below street consensus of a 0.9% increase.

On Friday, Germany’s Q2 GDP grew by 0.6% QoQ (vs. 0.7% in Q1 GDP), translating into an annualized rate of 2.1%. The economic growth was underpinned by both household and government expenditure. Should the strong first half momentum carry into the remainder of 2017, will it accelerate the case for tapering the asset purchases program, as far as the European Central Bank (ECB) is concerned?

Speaking about tapering, during the economic symposium in Jackson Hole, Wyoming, Federal Reserve Chair Janet Yellen defended and elaborated on the net benefits of enacting financial regulations. Nonetheless, she discussed neither the economic outlook nor monetary policy in her speech (Source: FRB). See below excerpts.

Investors were not impressed by Yellen’s speech as they expected more color surrounding the subject of balance sheet reduction.

Gold futures received a boost amid continued uncertainty in monetary policy coupled with political instability in the White House.

The yield on U.S. 10-Year Treasury note fell accordingly.

The ECB President Mario Draghi subsequently delivered his speech, which was uneventful as well. His tone was deemed neither hawkish nor dovish, and he strove to avoid specific discussions on current market conditions and the tapering of ECB’s bond purchases program, before the quantitative tightening messages, which are expected to be delivered throughout the rest of 2017. Euro rose to the highest level against the greenback since early January 2015.

Lastly, here is a decent write-up pertaining to the macroeconomic outlook as well as the corresponding asset allocation suggested by PIMCO. (Source: PIMCO).

The week ahead: U.S. will release its August consumer confidence reading on Tuesday (Aug 29); China will publish its official manufacturing PMI in August and U.S. will release its revised Q2 GDP on Wednesday (Aug 30); China will report its Caixin manufacturing PMI in August, U.S. will release its July pending home sales, the eurozone will publish its inflation data and unemployment rate, and Canada will release Q2 2017 GDP results on Thursday (Aug 31); U.S. will report its nonfarm payrolls, unemployment rate, and manufacturing PMI in August (Sep 1).

Share this:

About AM_Journey

A small potato working on Bay Street