U.S. stock market closed mixed on Friday as investors digested worse than expected non-farm payroll results.

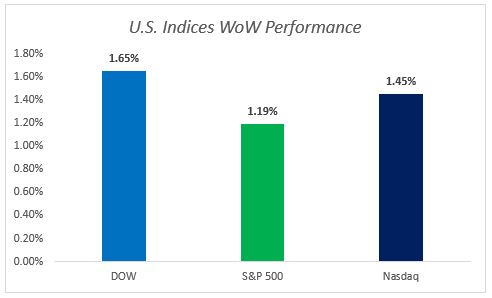

The Dow Jones industrial average slipped 1.72 points (-0.01%) to settle at 22,773.67, with Boeing and Chevron contributing the most to the losses. The S&P 500 dropped 2.74 points (-0.11%) to finish at 2,549.33, led by consumer staples and telecom stocks. Nasdaq composite inched up 4.82 points (0.07%) to close at 6,590.18. For the week as a whole, all three U.S. stock indexes managed to stay the green again with Dow Jones slightly outperforming the rest.

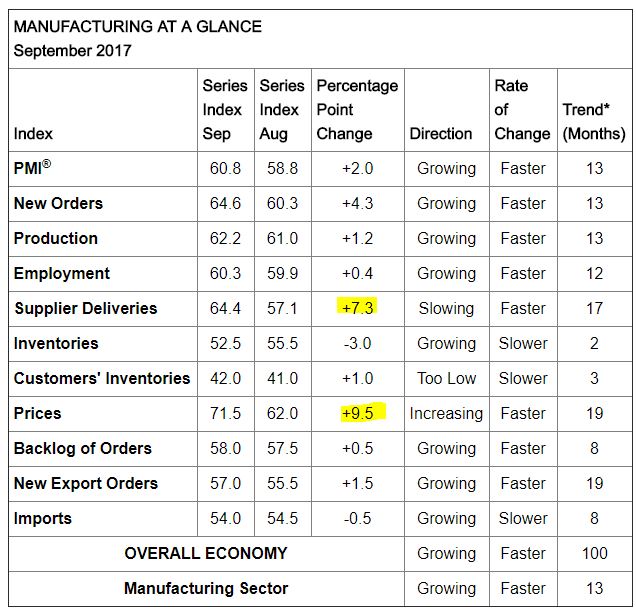

On Monday, U.S. released its September Manufacturing PMI figure, which jumped to 60.8 (vs. 58.8 in August), the highest level in more than 13 years and ahead of street expectations of 58.0. The beat was attributable to a surge in supplier deliveries and prices sub-indexes, which in turn were driven by hurricanes that took place in the past few weeks.

Source: ISM

Source: ISM

On the other hand, after enjoying a two-month increase, U.K. witnessed its September Manufacturing PMI figure reversed to 55.9 (56.9 in August), as the boost to exporters from the weak sterling is offset by rising production costs, as well as ongoing uncertainty surrounding Brexit. Speaking about the U.K., the prime minister Theresa May is currently faced with doubt regarding her leadership and her ability to execute Brexit as planned.

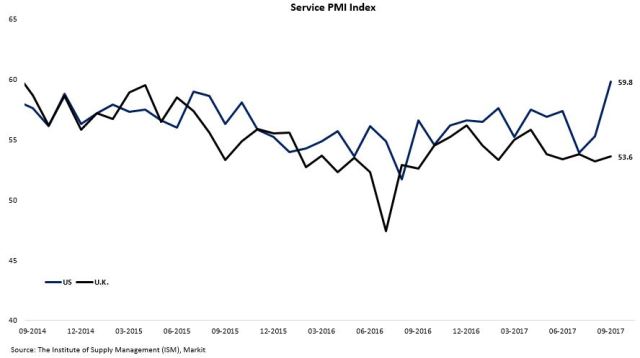

On Tuesday, both the U.S. and U.K reported their Non-Manufacturing/Services PMI results, with the former surging to 59.8 (vs. 55.3 in August) due the aforementioned impact from the hurricanes, and the latter ticking up to 53.6 (vs. 53.2 in August), better than market expectations of a flat figure as in August. Note that once again, U.K. service sector accounts for over 75% of the nation’s GDP, thus making the Services PMI figure an imperative indicator to monitor.

In addition, U.S. private sector added 135,000 jobs in September, beating economists’ expectations of 125,000, even after incorporating the adverse impact from Hurricane Harvey and Irma, according to ADP Research Institute. The job growth was mostly concentrated at larger firms, while small companies saw their staffing level decline.

Source: ADP

Source: ADP

On Thursday, U.S. stock market hit another record high amid progress towards advancing the tax reform implementation. S&P 500 has secured a eight-day winning streak while VIX hit another record low. Are we due for another correction soon?

Source: WSJ

Source: WSJ

On to the eurozone, the European Central Bank (ECB) remained on track to end their bond-purchasing programme next year, despite soft wage inflation and the strength of the euro, according to its minutes. The market continued to expect ECB to announce plans to wind down its QE programme later on in October.

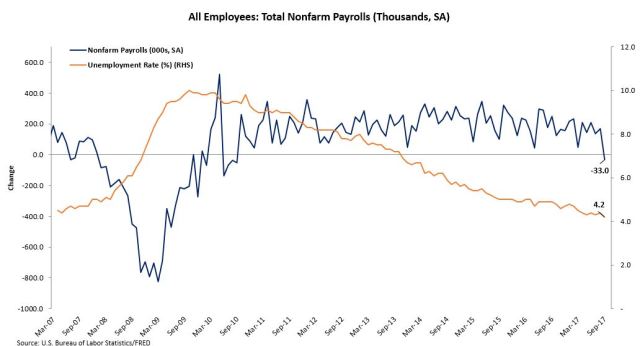

On Friday, U.S. reported its September non-farm payrolls results, registering a 30,000 job losses, significantly below the street consensus of 80,000 job gains. It goes without saying that hurricanes Harvey and Irma combined to bring an end to a seven-year streak of positive US payroll reports. Nonetheless, unemployment rate declined to a 16-year low of 4.2% (vs. 4.4% in August) due to a temporarily smaller labour force.

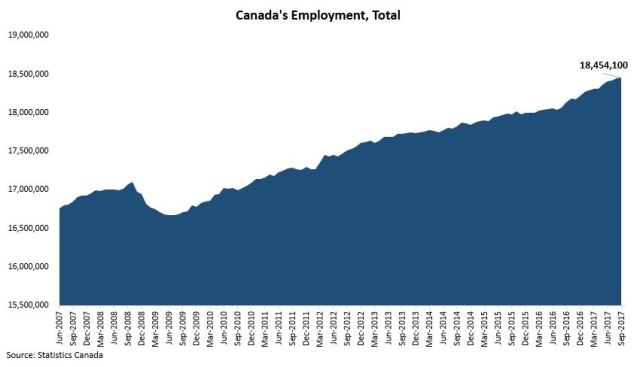

On to Canada, the country added another 10,000 job in September, the 10th-month with positive net job gains. This helped maintain the nation’s unemployment rate at 6.2% (vs. 6.2% in August). On a year-over-year basis, the employment level increased by 1.8% to 18.45 million.

Lastly in Canada, the nation’s real estate market (especially in BC and ON) continued to worry the market regarding the prospect of the sector as well as the underlying impact on the economy. With B-20 mortgage rule moving towards the beginning of implementation, gradually increasing interest rates, as well as the record level of household indebtedness in the country, consumers and businesses should remain cautious about the near-term headwind in the real estate sector.

The week ahead: U.K. will release its August manufacturing production result on Tuesday (Oct 10); The Federal Reserve will publish its latest FOMC minutes on Wednesday (Oct 11); U.S. will report its September Producer Price Index figure on Thursday (Oct 12); China will publish its trade balance reading and U.S. will release its September CPI and Retail Sales figures (Oct 13).

Tops News

Tops News Economic Calendar & News

Economic Calendar & News Economy

Economy

Market Commentary – October 6, 2017

U.S. stock market closed mixed on Friday as investors digested worse than expected non-farm payroll results.

The Dow Jones industrial average slipped 1.72 points (-0.01%) to settle at 22,773.67, with Boeing and Chevron contributing the most to the losses. The S&P 500 dropped 2.74 points (-0.11%) to finish at 2,549.33, led by consumer staples and telecom stocks. Nasdaq composite inched up 4.82 points (0.07%) to close at 6,590.18. For the week as a whole, all three U.S. stock indexes managed to stay the green again with Dow Jones slightly outperforming the rest.

On Monday, U.S. released its September Manufacturing PMI figure, which jumped to 60.8 (vs. 58.8 in August), the highest level in more than 13 years and ahead of street expectations of 58.0. The beat was attributable to a surge in supplier deliveries and prices sub-indexes, which in turn were driven by hurricanes that took place in the past few weeks.

On the other hand, after enjoying a two-month increase, U.K. witnessed its September Manufacturing PMI figure reversed to 55.9 (56.9 in August), as the boost to exporters from the weak sterling is offset by rising production costs, as well as ongoing uncertainty surrounding Brexit. Speaking about the U.K., the prime minister Theresa May is currently faced with doubt regarding her leadership and her ability to execute Brexit as planned.

On Tuesday, both the U.S. and U.K reported their Non-Manufacturing/Services PMI results, with the former surging to 59.8 (vs. 55.3 in August) due the aforementioned impact from the hurricanes, and the latter ticking up to 53.6 (vs. 53.2 in August), better than market expectations of a flat figure as in August. Note that once again, U.K. service sector accounts for over 75% of the nation’s GDP, thus making the Services PMI figure an imperative indicator to monitor.

In addition, U.S. private sector added 135,000 jobs in September, beating economists’ expectations of 125,000, even after incorporating the adverse impact from Hurricane Harvey and Irma, according to ADP Research Institute. The job growth was mostly concentrated at larger firms, while small companies saw their staffing level decline.

On Thursday, U.S. stock market hit another record high amid progress towards advancing the tax reform implementation. S&P 500 has secured a eight-day winning streak while VIX hit another record low. Are we due for another correction soon?

On to the eurozone, the European Central Bank (ECB) remained on track to end their bond-purchasing programme next year, despite soft wage inflation and the strength of the euro, according to its minutes. The market continued to expect ECB to announce plans to wind down its QE programme later on in October.

On Friday, U.S. reported its September non-farm payrolls results, registering a 30,000 job losses, significantly below the street consensus of 80,000 job gains. It goes without saying that hurricanes Harvey and Irma combined to bring an end to a seven-year streak of positive US payroll reports. Nonetheless, unemployment rate declined to a 16-year low of 4.2% (vs. 4.4% in August) due to a temporarily smaller labour force.

On to Canada, the country added another 10,000 job in September, the 10th-month with positive net job gains. This helped maintain the nation’s unemployment rate at 6.2% (vs. 6.2% in August). On a year-over-year basis, the employment level increased by 1.8% to 18.45 million.

Lastly in Canada, the nation’s real estate market (especially in BC and ON) continued to worry the market regarding the prospect of the sector as well as the underlying impact on the economy. With B-20 mortgage rule moving towards the beginning of implementation, gradually increasing interest rates, as well as the record level of household indebtedness in the country, consumers and businesses should remain cautious about the near-term headwind in the real estate sector.

The week ahead: U.K. will release its August manufacturing production result on Tuesday (Oct 10); The Federal Reserve will publish its latest FOMC minutes on Wednesday (Oct 11); U.S. will report its September Producer Price Index figure on Thursday (Oct 12); China will publish its trade balance reading and U.S. will release its September CPI and Retail Sales figures (Oct 13).

Share this:

About AM_Journey

A small potato working on Bay Street