U.S. equities reached record highs on Friday as investors remained cautiously optimistic towards strong bank earnings as they kicked off Q3 earnings season.

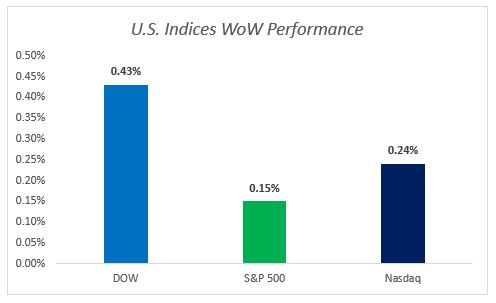

The Dow Jones industrial average was up 30.71 points (0.13%) to close at 22,871.72, mostly driven by Procter & Gamble and Apple stocks. The S&P 500 ticked up 2.24 points (0.09%) to settle at 2,553.17, with materials and technology stocks leading the gains. Nasdaq composite rose 14.29 points (0.22%) to finish at 6,605.80. For the week ended 13th, U.S. stock indexes registered the third consecutive week of gains with Dow Jones outperforming the rest for the second time.

On Tuesday, U.S. President Donald Trump continued to escalate his tension with his Secretary of State, Rex Tillerson by requesting an IQ test battle, in response to Tillerson’s earlier words calling Trump a “moron”.

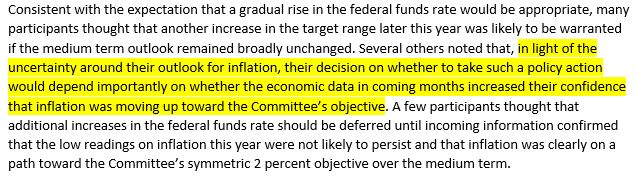

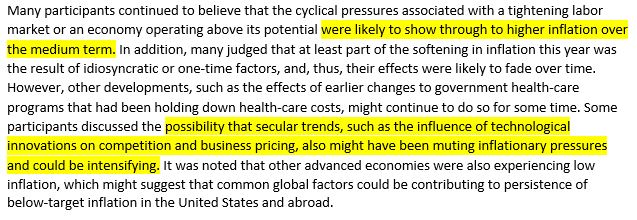

On Wednesday, the Federal Reserve (Fed) released its latest FOMC minutes, which did not offer anything novel beyond market expectations. The balance sheet reduction will commence in October as planned, and investors are pricing in over 80% odds of another rate hike in December, according to CME Group. See below selected excerpts of FOMC minutes. The takeaway is that, the Fed is aware of the soft inflation data but remains confident that tight labour market (i.e.: persistently low unemployment rate) would translate into higher price pressures. That is, low inflation is transitory, at least from their vantage point.

Source: FRB

Source: FRB

On Thursday, U.S. President Donald Trump signed an executive order to direct federal agencies to pursue sweeping regulatory changes to the health-care system. In other words, the cost sharing system would be revoked and certain citizens who do not need health care are not required to pay a similar amount as those who do. However, the downside of this change is that premiums are likely to go up next year, making the overall health care system more costly, let alone the fact that less people will be able to afford health care.

In addition, U.S. producer price index jumped 2.6% YoY in September (vs. 2.4% in August) as gasoline price recorded its biggest increase in more than two years amid production disruptions at oil refineries in Texas caused by Hurricane Harvey.

On to the eurozone, the European Central Bank (ECB) is setting stage for trimming its quantitative easing (QE) program, according to statements from some of the officials. One proposal that is being considered is to cut the bond purchasing scale in half, from €60 billion to €30 billion beginning in 2018, and maintaining the program active for at least nine months. At the same time, ECB president Mario Draghi said in Washington that interest rates will stay put until well past the end of QE.

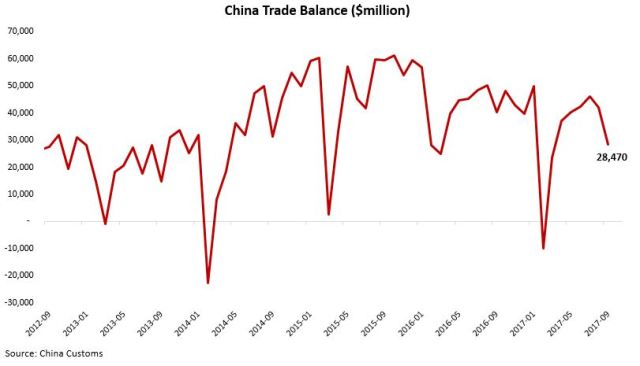

On Friday, China reported its September trade balance figure, which came in at $28.47 trillion, the lowest since March 2017. The nation’s exports rose 8.1% YoY, while its imports jumped 18.7% YoY. Note that China’s imports from North Korea dropped more than 35% compared to last year.

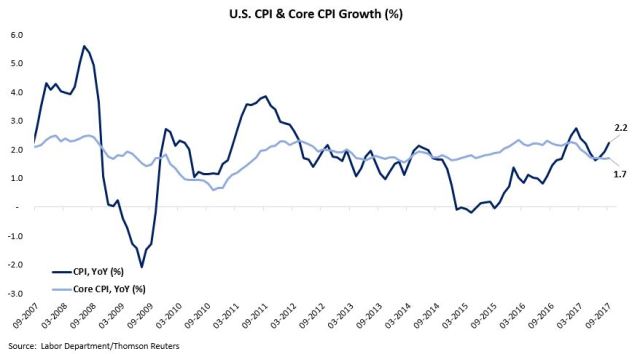

Considering the upward price pressures witnessed in a number of economic indicators discussed recently, it is no surprise that the U.S. inflation data would also receive a temporary boost. The country’s consumer price index (CPI) recorded its biggest increase in eight months in September as gasoline prices jumped in light of hurricane-related oil production disruptions. Hence, CPI rose 2.2% in September (vs. 1.9% in August) while core CPI growth remained at 1.7% (vs. 1.7% in August).

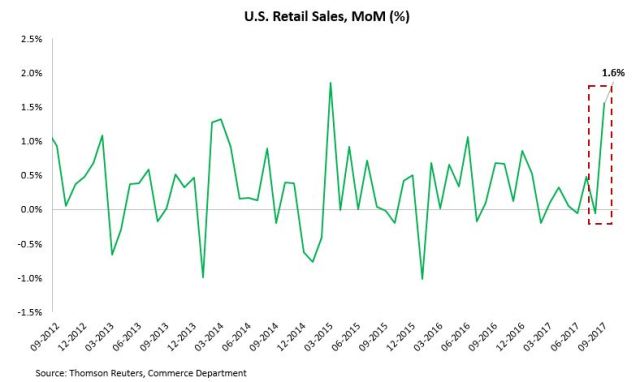

Further, U.S. retail sales registered their largest MoM increase since March 2015, growing 1.6% in September (vs. -0.1% losses in August), mainly driven by higher gasoline prices in the wake of Hurricane Harvey and a surge in vehicle sales.

Lastly, while Bitcoin hit another record high of $5,800, CEO of JPMorgan Chase, Jamie Dimon seemed to stick to his gun regarding his disapproval of crytocurrencies.

The week ahead: China will report its September CPI reading on Monday (Oct 16); both U.K. and the eurozone will publish its September CPI results, and U.S. will release its industrial production data on Tuesday (Oct 17); U.S. will report building permits figures in September, China will release its Q3 GDP, retail sales, and industrial production results on Wednesday (Oct 18); U.K. will also release its September retail sales figures on Thursday (Oct 19); U.S. will report its September existing home sales data and Canada will publish its CPI and retail sales in September on Friday (Oct 20).

Tops News

Tops News Economic Calendar & News

Economic Calendar & News Economy

Economy

Market Commentary – October 13, 2017

U.S. equities reached record highs on Friday as investors remained cautiously optimistic towards strong bank earnings as they kicked off Q3 earnings season.

The Dow Jones industrial average was up 30.71 points (0.13%) to close at 22,871.72, mostly driven by Procter & Gamble and Apple stocks. The S&P 500 ticked up 2.24 points (0.09%) to settle at 2,553.17, with materials and technology stocks leading the gains. Nasdaq composite rose 14.29 points (0.22%) to finish at 6,605.80. For the week ended 13th, U.S. stock indexes registered the third consecutive week of gains with Dow Jones outperforming the rest for the second time.

On Tuesday, U.S. President Donald Trump continued to escalate his tension with his Secretary of State, Rex Tillerson by requesting an IQ test battle, in response to Tillerson’s earlier words calling Trump a “moron”.

On Wednesday, the Federal Reserve (Fed) released its latest FOMC minutes, which did not offer anything novel beyond market expectations. The balance sheet reduction will commence in October as planned, and investors are pricing in over 80% odds of another rate hike in December, according to CME Group. See below selected excerpts of FOMC minutes. The takeaway is that, the Fed is aware of the soft inflation data but remains confident that tight labour market (i.e.: persistently low unemployment rate) would translate into higher price pressures. That is, low inflation is transitory, at least from their vantage point.

On Thursday, U.S. President Donald Trump signed an executive order to direct federal agencies to pursue sweeping regulatory changes to the health-care system. In other words, the cost sharing system would be revoked and certain citizens who do not need health care are not required to pay a similar amount as those who do. However, the downside of this change is that premiums are likely to go up next year, making the overall health care system more costly, let alone the fact that less people will be able to afford health care.

In addition, U.S. producer price index jumped 2.6% YoY in September (vs. 2.4% in August) as gasoline price recorded its biggest increase in more than two years amid production disruptions at oil refineries in Texas caused by Hurricane Harvey.

On to the eurozone, the European Central Bank (ECB) is setting stage for trimming its quantitative easing (QE) program, according to statements from some of the officials. One proposal that is being considered is to cut the bond purchasing scale in half, from €60 billion to €30 billion beginning in 2018, and maintaining the program active for at least nine months. At the same time, ECB president Mario Draghi said in Washington that interest rates will stay put until well past the end of QE.

On Friday, China reported its September trade balance figure, which came in at $28.47 trillion, the lowest since March 2017. The nation’s exports rose 8.1% YoY, while its imports jumped 18.7% YoY. Note that China’s imports from North Korea dropped more than 35% compared to last year.

Considering the upward price pressures witnessed in a number of economic indicators discussed recently, it is no surprise that the U.S. inflation data would also receive a temporary boost. The country’s consumer price index (CPI) recorded its biggest increase in eight months in September as gasoline prices jumped in light of hurricane-related oil production disruptions. Hence, CPI rose 2.2% in September (vs. 1.9% in August) while core CPI growth remained at 1.7% (vs. 1.7% in August).

Further, U.S. retail sales registered their largest MoM increase since March 2015, growing 1.6% in September (vs. -0.1% losses in August), mainly driven by higher gasoline prices in the wake of Hurricane Harvey and a surge in vehicle sales.

Lastly, while Bitcoin hit another record high of $5,800, CEO of JPMorgan Chase, Jamie Dimon seemed to stick to his gun regarding his disapproval of crytocurrencies.

The week ahead: China will report its September CPI reading on Monday (Oct 16); both U.K. and the eurozone will publish its September CPI results, and U.S. will release its industrial production data on Tuesday (Oct 17); U.S. will report building permits figures in September, China will release its Q3 GDP, retail sales, and industrial production results on Wednesday (Oct 18); U.K. will also release its September retail sales figures on Thursday (Oct 19); U.S. will report its September existing home sales data and Canada will publish its CPI and retail sales in September on Friday (Oct 20).

Share this:

About AM_Journey

A small potato working on Bay Street