U.S. equities rallied on Friday as yields fell from recent high, pushing stocks higher by the end of this week’s trading session.

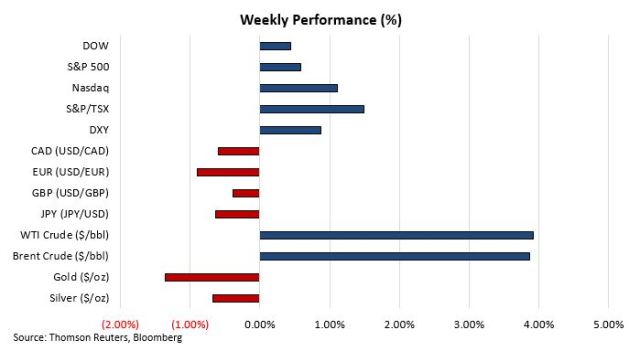

The Dow Jones industrial average jumped 347.51 points (1.39%) to close at 25,309.99, thanks to rallies in Goldman Sachs and Intel stocks. The S&P 500 surged 43.34 points (0.04%) to finish at 2,747.30, largely driven by utilities and energy sectors. Nasdaq composite rose 127.30 points (1.77%) to settle at 7,337.39, ending its four-session losing streak. For the week as a whole, all three major indexes managed to stay in the green, with Nasdaq outperforming the other indexes.

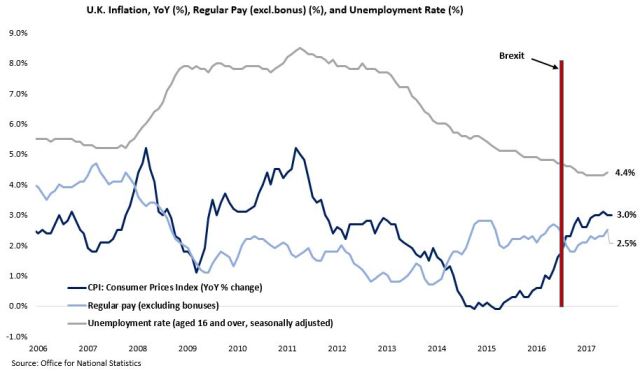

On Wednesday, U.K. labour market remained resilient despite ongoing uncertainties stemming from Brexit. Unemployment rate stayed at decade-low of 4.4% in December (vs. 4.3% in November), whereas wage growth continued to witness acceleration, with regular pay (excluding bonuses) growing at 2.5% in the three months to December (vs. 2.3% in the three months to November).

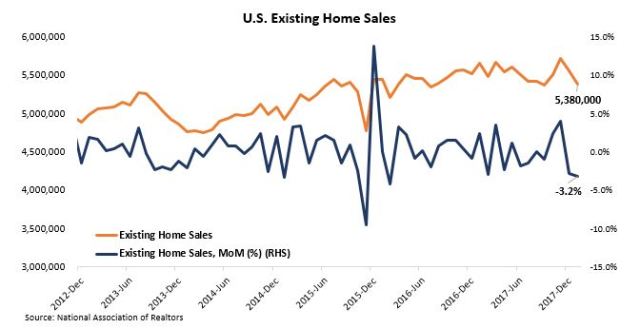

In addition, U.S. existing home sales results remained sluggish for the second month in a row, declining 3.2% MoM (vs. -2.8% in December) to a seasonally adjusted annual rate of 5.38 million units in January, driven by continued shortage of home supply.

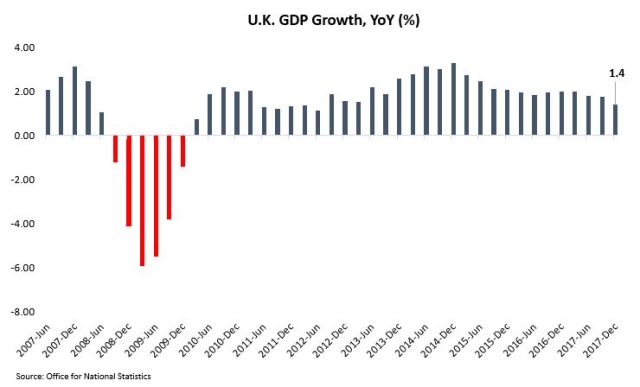

On Thursday, U.K. revised its Q4 GDP to 0.4%, down from its preliminary reading of 0.5%, largely due to downward revisions in commodities and services activities. On an annual basis, GDP rose by 1.4% in Q4 (vs. 1.8% in Q3), the lowest in five years and it is sitting at the bottom of the G7 countries except Canada, which is yet to release its results.

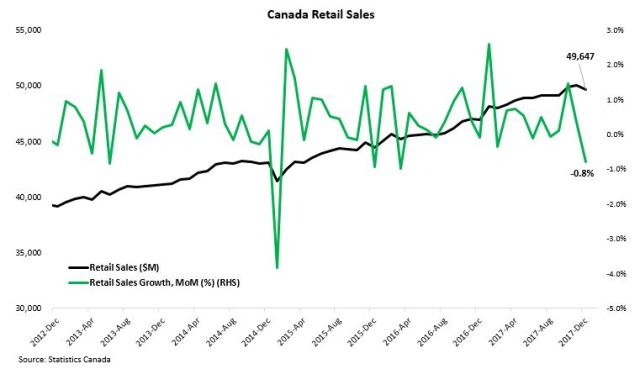

On to Canada, the nation’s December retail sales surprised to the downside and fell 0.8% MoM (vs. 0.3% in November), below economists expectation of 0.3% gains. The decline was mostly driven by sluggish sales in electronics and appliances and this will likely exert downward pressure on the Q4 GDP figure, which will be reported next Friday.

On Friday, Canada reported lower headline inflation, up 1.7% YoY in January (vs. 1.9% in December); while the inflation gauge monitored closely by Bank of Canada (BoC), CPI common, rose 1.8% YoY (vs. 1.6% in December). Despite the soft retail sales coupled with solid inflation figures, the street continues to believe the next interest rate hike could arrive as soon as in April.

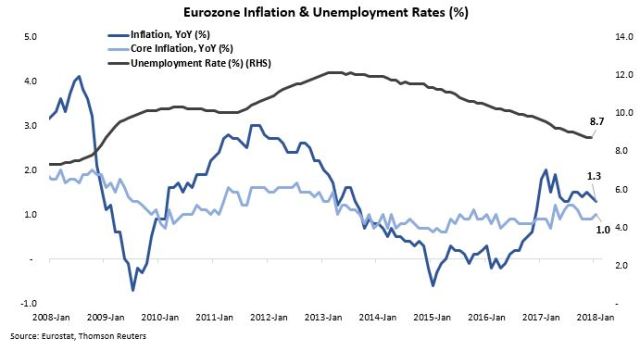

Further, eurozone reported its final inflation reading in January, rising 1.3% YoY (vs. 1.4% in December) while the core inflation growth ticked up to 1.0% YoY (vs. 0.9% in December). Inflation results remained below the European Central Bank’s 2% target, despite strong labour markets.

Lastly, here is a decent summary of how blockchain could disrupt the financial industry (Source: CBInsights).

The week ahead: U.S. will publish January new home sales on Monday (Feb 26); U.S. will release February consumer confidence reading and China will report February official manufacturing PMI results on Tuesday (Feb 27); U.S. will release preliminary Q4 GDP results and January pending home sales, and China will publish February Caixin manufacturing PMI figures on Wednesday (Feb 28); U.S. will report February manufacturing PMI on Thursday (Mar 1); U.S. will release February employment report and Canada will publish Q4 GDP reading on Friday (Mar 2).

Tops News

Tops News Economic Calendar & News

Economic Calendar & News Economy

Economy

Market Commentary – February 23, 2018

U.S. equities rallied on Friday as yields fell from recent high, pushing stocks higher by the end of this week’s trading session.

The Dow Jones industrial average jumped 347.51 points (1.39%) to close at 25,309.99, thanks to rallies in Goldman Sachs and Intel stocks. The S&P 500 surged 43.34 points (0.04%) to finish at 2,747.30, largely driven by utilities and energy sectors. Nasdaq composite rose 127.30 points (1.77%) to settle at 7,337.39, ending its four-session losing streak. For the week as a whole, all three major indexes managed to stay in the green, with Nasdaq outperforming the other indexes.

On Wednesday, U.K. labour market remained resilient despite ongoing uncertainties stemming from Brexit. Unemployment rate stayed at decade-low of 4.4% in December (vs. 4.3% in November), whereas wage growth continued to witness acceleration, with regular pay (excluding bonuses) growing at 2.5% in the three months to December (vs. 2.3% in the three months to November).

In addition, U.S. existing home sales results remained sluggish for the second month in a row, declining 3.2% MoM (vs. -2.8% in December) to a seasonally adjusted annual rate of 5.38 million units in January, driven by continued shortage of home supply.

On Thursday, U.K. revised its Q4 GDP to 0.4%, down from its preliminary reading of 0.5%, largely due to downward revisions in commodities and services activities. On an annual basis, GDP rose by 1.4% in Q4 (vs. 1.8% in Q3), the lowest in five years and it is sitting at the bottom of the G7 countries except Canada, which is yet to release its results.

On to Canada, the nation’s December retail sales surprised to the downside and fell 0.8% MoM (vs. 0.3% in November), below economists expectation of 0.3% gains. The decline was mostly driven by sluggish sales in electronics and appliances and this will likely exert downward pressure on the Q4 GDP figure, which will be reported next Friday.

On Friday, Canada reported lower headline inflation, up 1.7% YoY in January (vs. 1.9% in December); while the inflation gauge monitored closely by Bank of Canada (BoC), CPI common, rose 1.8% YoY (vs. 1.6% in December). Despite the soft retail sales coupled with solid inflation figures, the street continues to believe the next interest rate hike could arrive as soon as in April.

Further, eurozone reported its final inflation reading in January, rising 1.3% YoY (vs. 1.4% in December) while the core inflation growth ticked up to 1.0% YoY (vs. 0.9% in December). Inflation results remained below the European Central Bank’s 2% target, despite strong labour markets.

Lastly, here is a decent summary of how blockchain could disrupt the financial industry (Source: CBInsights).

The week ahead: U.S. will publish January new home sales on Monday (Feb 26); U.S. will release February consumer confidence reading and China will report February official manufacturing PMI results on Tuesday (Feb 27); U.S. will release preliminary Q4 GDP results and January pending home sales, and China will publish February Caixin manufacturing PMI figures on Wednesday (Feb 28); U.S. will report February manufacturing PMI on Thursday (Mar 1); U.S. will release February employment report and Canada will publish Q4 GDP reading on Friday (Mar 2).

Share this:

About AM_Journey

A small potato working on Bay Street